59. Sean Ring: What Successful Entrepreneurs Understand About Iteration

Hunter Hastings asks Sean Ring, Finlingo Co-founder and CEO, for his number one secret for entrepreneurial success. His answer: Iteration.

Sean offers additional insights, as we’ll see below, but the power of iteration is his number one: doing things over and over, with a view to improving. Always learning, always changing, never getting tired of improving and tinkering, whether it’s with your life path, your self-knowledge, your skills, your code base or your business. You can never predict the future, but you can always monitor your felt uneasiness and take action to relieve it by doing better.

Key Takeaways and Actionable Insights

Sean navigated his lifepath through specialized areas of the financial services industry and through multiple locations around the globe, accumulating knowledge and insight at every step along the way.

Armed with degrees in finance, Sean found his way into banking, and into derivatives accounting with Lehman Brothers. Then to the “back office” (operations) at Credit Suisse, then the front office, then client management. It was a winding path, finding out what he was good at, where he needed to improve, and what he liked and disliked about corporate life. He worked in New York City and London got a taste of international travel and living that he enjoyed.

He took a pause: time off and a self-assessment to organize his individual resources.

The corporate treadmill can be mesmerizing. Sean took a year off to take his bearings, including a measurement of his personality traits using the OCEAN model, as well as subjectively self-assessing his strengths and areas for improvement.

He began to focus on organization — both the entrepreneurial function and the personal skill. Not only was organization a way to self-improve, it was a step on the pathway to entrepreneurship, the role that Joe Salerno describes, from Mises, as supervising and organizing the various elements of productive property into a coherent structure of means, i.e. the firm.

He identified financial training as his professional field.

Sean found he was excellent in front of the class. His communications abilities enabled him to express complex topics so that young trainees would understand and absorb them. His hard work ensured no gaps or weaknesses in his training materials. His gregariousness helped him to learn from other experts. He found himself highly motivated by helping young people embark upon the path as he had followed, but armed by Sean with more knowledge.

At the same time, Sean himself never stopped accumulating certifications, qualification and badges.

Skills need continuous refreshment. In the financial services industry, there are complex technical issues to master, from financial instruments to trading techniques to compliance to ethics. Sean dedicated himself to accumulating a wide range of certifications, both to confirm his own levels of technical excellence in his field, and to communicate to others his rigorous pursuit of knowledge. He is a big believer in testing and its importance in maintaining quality and integrity in service industries like finance where technical complexity sometimes doesn’t combine well with transparent and high-trust relationship practices — what Sean calls the combination of hard skills and soft skills.

And he found a business partner with complementary skills and a shared mindset.

Between them, Sean and his business partner Andy Duncan combine marketing / sales / communications / finance expertise with coding, A.I., and cognitive psychology. They share founders’ ambitions, work together well, and both enjoy Austrian Economics. Entrepreneurial initiatives are more likely to succeed when two or more partners can combine relevant skills and experience in a collaborative relationship.

All these steps bring Sean to a logical milestone on his life path: co-founder and CEO of a tech start-up employing advanced technology to achieve new levels of testing integrity to his industry.

Finlingo employs AI and advanced coding to write exam questions for technically complex financial certifications and to infinitely replicate those questions, so that no two candidates get the same questions, no questions can be memorized, and the exams can’t be stolen or hacked. Instructors and institutions enjoy a write-once-and-relax experience in composing questions and setting exams, a significant relief of uneasiness.

Sean shares his 5 key learnings for a successful entrepreneur’s journey.

- Iteration: Entrepreneurs learn that they’re wrong every day. Every fork can be re-taken. Every initiative can be improved. Every left turn can be re-thought as a right turn. Keep iterating.

- Humility: The mindset for iteration is humility – entrepreneurs know that they don’t know a lot, that every decision is based on imperfect knowledge, and every judgement is subject to uncertainty.

- Self-awareness: Deal with your own internal pressure; manage your own expectations – success does not necessarily come quickly and you don’t necessarily advance in a straight line at a constant pace.

- Lean cost discipline: Keep costs low, and don’t bankrupt yourself by spending too much too soon. Afford yourself the opportunity to make the mistakes you need to make.

- Family: Keep your spouse or partner supportive; communicate well.

Sean’s Principles of Austrian Economics

What are the principles of economics most useful for business success?

- Subjective value: Entrepreneurs can easily get wrapped up in their own (objective) beliefs about the importance and market impact of their product or service. The only thing that matters is how customers feel about it. Truly understanding subjective value and thinking and feeling like the customer is a key to success. Sean asks: what is the wish list inside the customer’s mind at any one given moment and where does your service stand on that list. Top of the list may be the pressing need to pick the kids up from school when you are trying to sell an annuity or insurance policy. Be aware, and empathetic.

- Customer sovereignty: “The market always asserts itself”, in Sean’s phrasing. It tells you what it wants. The market is the real boss. Listen to the market feedback and interpret it intelligently. The market may want features that you think are unimportant. The feedback may come to you as “not easy to use” when the right interpretation is “build me a better dashboard”.

- Unique assembly of assets: Entrepreneurial success is often a synthesis rather than the invention of a new-to-the-world idea. If a customer needs both A and B, and you can provide a service that integrates A with B, that might be enough to create a new business. No need to invent the wheel.

- Iterate, iterate, iterate.

Free Downloads & Extras

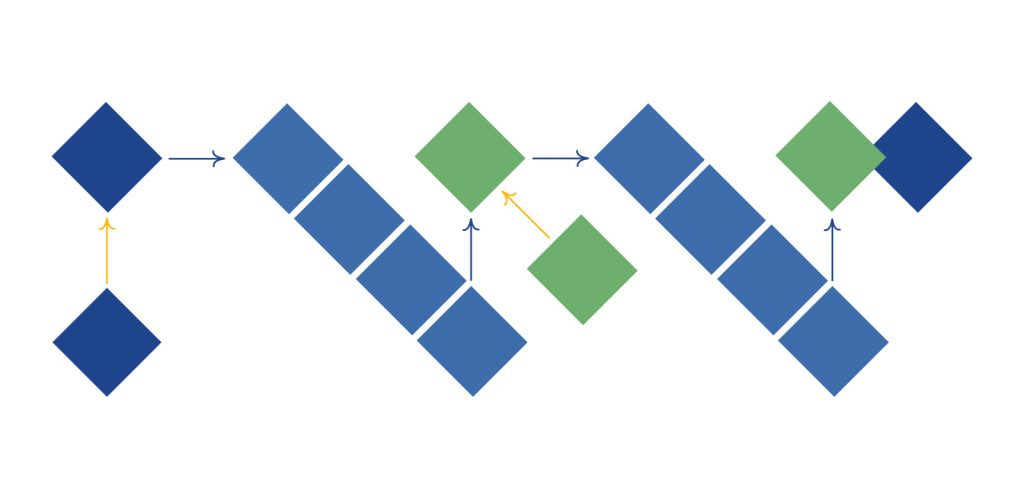

Iterating Towards Entrepreneurial Success: Our Free E4E Knowledge Graphic

Understanding The Mind of The Customer: Our Free E-Book

Start Your Own Entrepreneurial Journey

Ready to put Austrian Economics knowledge from the podcast to work for your business? Start your own entrepreneurial journey.

Enjoying The Podcast? Review, Subscribe & Listen On Your Favorite Platform:

Apple Podcasts, Google Play, Stitcher, Spotify