A new worldview for economics and business.

It’s exciting to live through a time of changing worldviews – when what we used to believe is shown to be wrong, and is replaced by new beliefs that are often still emerging and therefore somewhat open-ended. New doors open, new possibilities present themselves, there’s new energy.

The science of physics experienced this change of worldview in the later parts of the twentieth century and is still exploring new worlds in the twenty-first. The old worldview was Newton’s: that the universe was a machine, its motion and planetary interactions governed by unbreakable mathematical laws. This mechanistic view extended to all of natural and human life – whatever we examine, we look at it as a machine and try to figure out how it “works”, how the parts into which we can reduce the machine function together, and how it can be tuned for better performance. This mechanistic view extended to people and organizations, where we called it “management”.

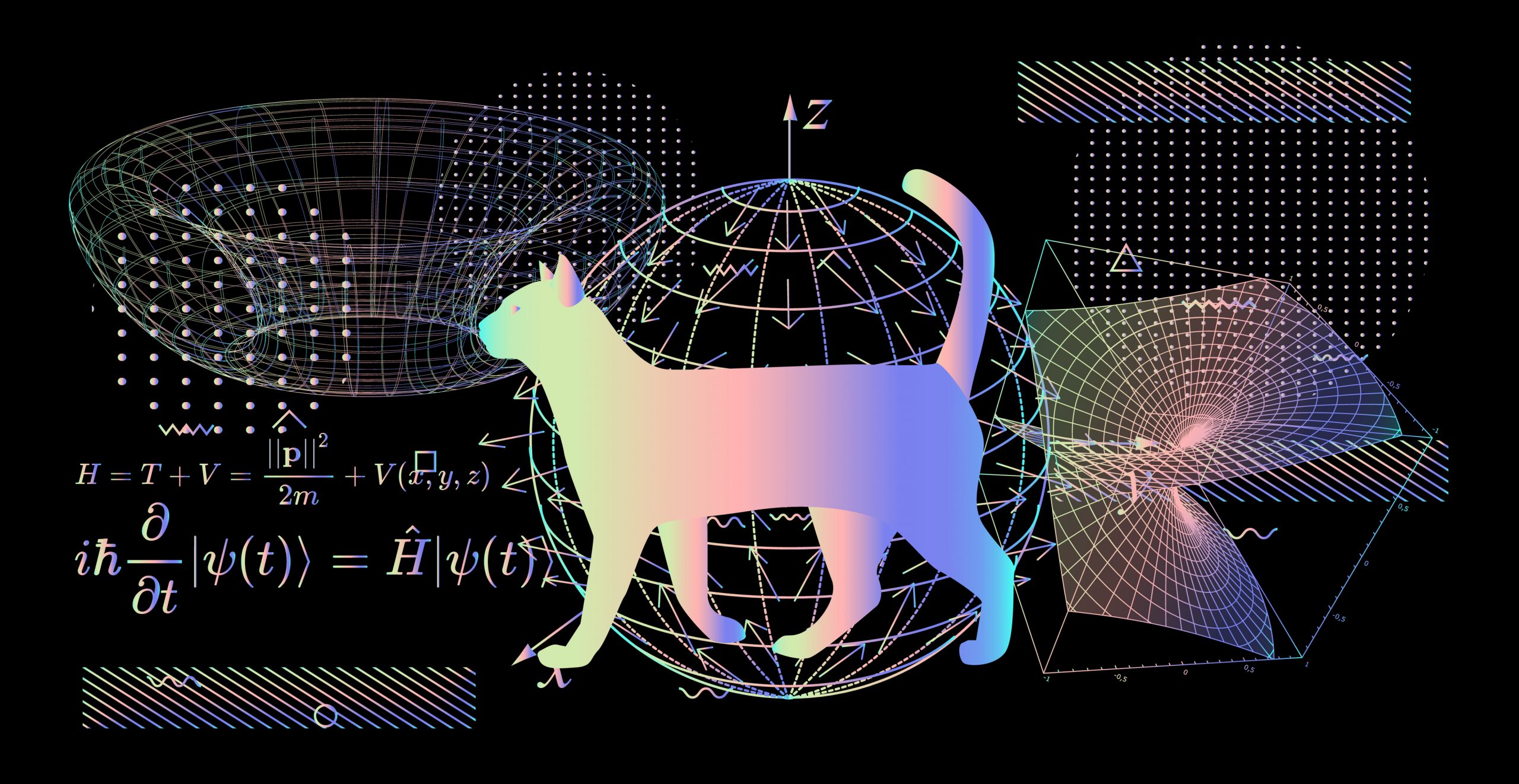

Fritjof Capra, in The Tao Of Physics, writes about “the fundamental change of worldview that is now occurring in science and society…..the unfolding of a new vision of reality”. The change stems from the discoveries of quantum physics, where the traditional idea of a material substance is replaced, and concepts of space, time and cause-and-effect are radically transformed. The machine-like image of how the world works is replaced by an image of dynamic flow; the world is forever in motion, time and change are essential features, and all phenomena are interrelated rather than separate, so that a change in one component affects all others, and hence affects the whole, which in turn re-affects the components through never-ending recursion of feedback loops. Quantum theory and relativity theory forced the world to change its worldview. There are no “basic building blocks” of matter that we can isolate, just a complicated web of waves and patterns of energy. The new world is not precise or predictable or measurable. it’s a world where opposites we don’t understand and can’t conceive of co-existing nevertheless apply. It’s a world of probabilities where there are multiple possible futures at any point, and therefore the possibility of many presents. It’s a bit spooky, as Einstein put it.

The world of economics and business is on the threshold of such a change in worldview. The same Newtonian mechanistic and mathematical approach that was applied in physics has been adopted in economics. The economy was viewed as a machine, churning out a numerical output identified as GDP. The efficiency of this machine could be calculated using algebra and equations. A certain amount of capital combined with a certain amount of labor and a factor that represents technological progress became the “model” for how the economy works. Within this larger machine were smaller component machines called firms, which combined capital and labor and technology in smaller and distinctive ways to contribute to total output. These machines were “managed” for high performance – organized as hierarchical command-and-control structures where the managers at the top who had all the equations and plans and visions instructed and directed the lower orders on how they should act. The worldview was quantitative and positivist, a word which we can translate as “there’s an equation that explains everything”.

The quantum equivalent in economics and business is the growing recognition that numbers and equations and top-down command and control management have no place in a system composed of human factors not machine parts. The economy is just such a system and firms are such systems. The appropriate worldview is the opposite of quantitative and positivist: it’s qualitative and subjectivist. Physicist Richard Feynman captured the difference in a well-turned phrase: “Imagine how much harder physics would be if electrons had feelings.” There could be no laws of physics, no continuity of data streams, no capturing of behavior in equations and algebraic symbols.

Economics and business concern humans. They are artifacts of human action and cultures of human feelings and emotions. The basic unit of analysis is the individual, both as worker and producer and as end-user, consumer and evaluator. Individuals are guided by their feelings, which change over time, and as context changes, and as they interact with others whose feelings are in play. The purpose of the economy is not to produce GDP, but to produce well-being, that feeling among individuals that they are better off compared to previous time periods and compared to alternatives. The economy gives individuals choices rather than giving them output. Firms are collections of individuals doing the same for customers – presenting them with choices and the proposition that making the choice will enhance their well-being – and for each other. The firm is a collaboration of people with aligned mindsets and shared assumptions and values engaged in offering well-being to others. There are no equations to help, and no hard-number metrics. There is subjective calculation – that well-being can be assessed, and can be monitored for its direction (getting better or worse) and its intensity (deeply felt as satisfaction or softly felt as contentment). There’s also the opposite assessment of unease or disquiet, which is the signal to the entrepreneurial firm that there’s the opportunity to generate new well-being that’s currently missing. There’s a market reward for getting this right, when satisfaction turns into willingness to pay and cash flows to the firm that makes well-being more possible and accessible for its customers.

These market rewards are flows, not to be measured by looking back over time at the end of the quarter or the year, but by looking forward to the future satisfactions that will keep the cash flowing, or sensing some fade in satisfaction which calls for innovation and an improved value proposition. Management is caring – caring about the customer experiencing value and feeling satisfaction and being confident in their choices. This is the new worldview. The old one brought with it the perception of capitalism as extractive and exploitative because there was no caring there, just numbers and equations. We are happy to move on.

Leave a Reply

Want to join the discussion?Feel free to contribute!