Your Value Proposition Language Is Your Customer Commitment And Your Company Culture.

Peter Drucker is famous for, among many other pieces of business wisdom, his statement that “there is only one valid definition of business purpose: to create a customer”.

That’s a statement with a lot of punch and a lot of clarity. It dismisses all the contemporary alternatives in the debate about the purpose of business firms, such as maximizing shareholder value or sustainability and environmental protection or stakeholder theory.

How do firms create customers? Peter Drucker was equally clear on this question:

“Because the purpose of business is to create a customer, the business enterprise has two–and only two–basic functions: marketing and innovation. Marketing and innovation produce results; all the rest are costs. Marketing is the distinguishing, unique function of the business.”

It’s certainly sound advice to place marketing and innovation at the front and center of business operations. Since 1954, when Drucker’s book, The Practice Of Management, was published, there have been great advances in defining how marketing is conducted and how innovation can be successfully introduced to the market.

The most recent advances have come from the field of economics, a discipline that is dissolving the walls that previously existed between it and psychology and cognitive science, and discovering a new understanding of how and why customers make their economic decisions to buy or abstain from buying, to increase or decrease their usage levels, and to maintain or abandon loyalty to a service provider or a brand.

The new discoveries concentrate in the phenomenon of value. Business language has embraced value in the past, and shifted its focus from value creation (the idea that value is produced within the firm) to value co-creation (the idea that value is produced jointly in an act of exchange between a service provider and a customer). Now, economics – and specifically that brand of economics known as Austrian economics – has identified that all value is created by the customer. It is the customers’ investment of time and effort and emotional commitment and intent to better their circumstances that creates value. Value emerges in the customer domain.

Behind this discovery is a new definitional understanding of value. It is a feeling in the customer’s mind, an experience that’s unique to each customer. Only the customer can have the experience. New research is revealing more about the experience – for example, that it is a learning experience. It takes place over time, beginning with an anticipation or estimate of future value (“what’s in it for me?”), an appraisal of relative value (“is it worth it?”), an exchange experience (the act of buying), a usage experience (the act of using the good or service) and finally an assessment of whether the experience met the expectations of the initial anticipation. The customer is busy and highly engaged in the physical, cognitive and emotional processes of value.

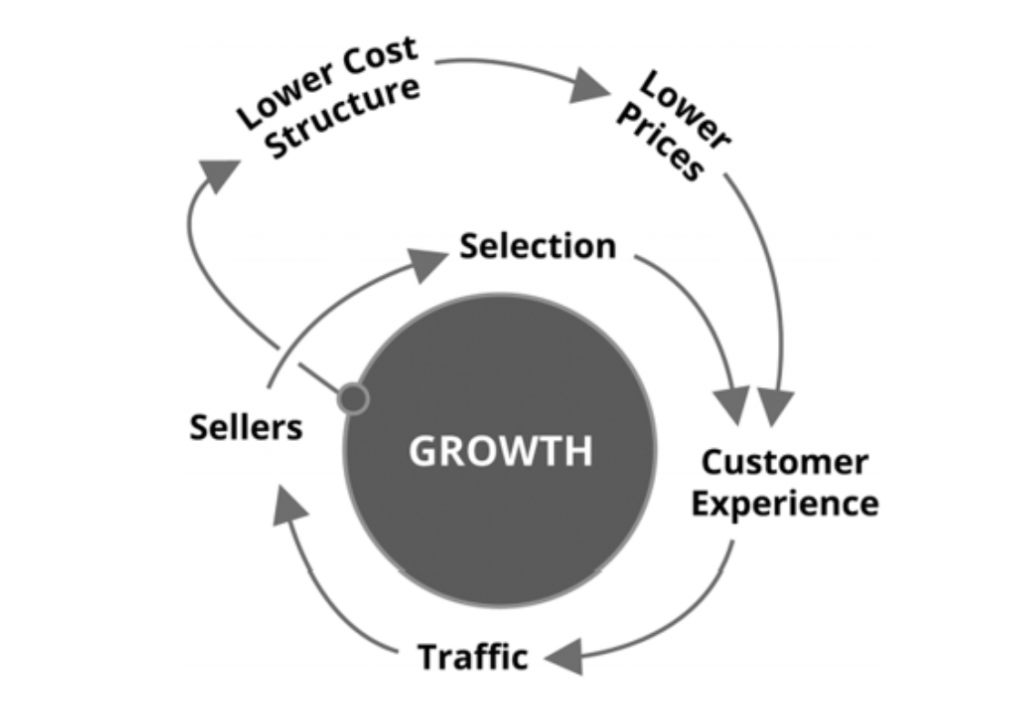

Where does all this leave the firm, and their marketing and innovation activities? The new discovery is that the successful firm is a facilitator – rather than a deliverer or creator – of value. There are degrees of facilitation ranging from passive (e.g. making a purchase opportunity available on an e-commerce site) to active (e.g., providing help-desk or personal service in real time when the customer is experiencing product usage), and many in between.

The pivot in the shift from value creation to value facilitation is the new role of the value proposition. Firms can create new information of which the customer is unaware, such as the development of a new service or the addition of new features to an existing service. Customers want to appraise the potential value represented by new information. They will make the decision, and they give some weight to information from the service provider.

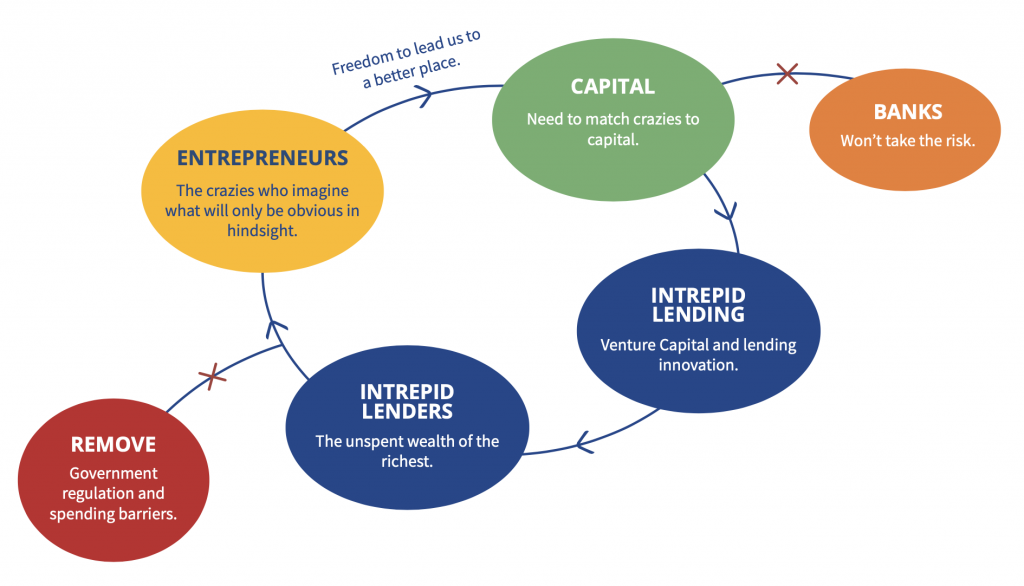

The first element of information in a sound value proposition is empathy. The value process begins with the customer’s pursuit of betterment. They give a signal to entrepreneurial innovators that betterment is possible: the signal is dissatisfaction. Customers can create value but they can’t design their own products and services. Their genius is to always want something better. The responsive entrepreneur diagnoses their inarticulate dissatisfaction using a highly tuned sense of empathy. The value proposition communicates to the customer that the entrepreneur expended significant effort at empathic diagnosis.

The next element of the value proposition is a promise. While unable to create value, firms and brands can promise that they have worked hard to find a way for their customers to experience value. The value proposition must demonstrate to customers that

- You recognize them as individuals. Show evidence.

- You understand their current dissatisfaction – reveal your empathic diagnosis.

- You offer a credible promise of relief.

- You reinforce your offer with reasons-to-believe. Before the customer engages emotionally, they want to engage rationally.

- You have a clear statement of benefits that you can demonstrate are greater than the customer’s cost. The customer’s cost includes not just willingness to pay, but also opportunity costs such as inertia, alternatives and value uncertainty. Help them with their economic calculation.

The value proposition sets the customer’s value learning process in motion: anticipating, weighing, exchanging, experiencing, assessing. The value proposition is your commitment to the customer that the process will be worthwhile, satisfying, enjoyable, and, ideally, beyond their expectations.

And this valuable exercise in making a promise does much more. Through its language, it becomes the culture of your company. Starting from Peter Drucker’s definition of business purpose, every employee, supplier, agent and partner should know their role in creating and retaining a customer.

In the language you use to recognize your customer and their dreams and hopes, their individual context and their preferences and desires, you’ll communicate to your organization how to love the customer and develop relationships. In the language you use to describe the customer’s current dissatisfaction, you’ll nurture an empathic organization. In the language you use to make a promise, you will embed commitment to keep it. In the language of credible and rational support for the promise, you’ll cement internal belief in the promise-keeping mission. And in the language of benefits to the customer, you’ll set the standards of customer-facing behavior and customer relationship management for everyone in your firm.

Yes, a value proposition is just language. In business strategy, language is all we have to tell each other how we will collaborate around a purpose, to share the tools and tactics we’ll all use, and to communicate the successes and learning opportunities that come from implementation and promise-keeping. And, most importantly, to invite the customer to allow us into their value learning process.

Value Proposition Deisgn and Template 5-minute audio for hh.com