The Value Creators Episode #48. New Access to Capital for Entrepreneurs with Brian Hollins

Brian Hollins is the founder and managing partner at Collide Capital, the Founder and CEO of Takeoff Institute, and aFounding Board Member at BLCKVC. He’s devoted his career to addressing and solving the challenges entrepreneurs face in accessing capital when they’re not plugged in to elite VC networks and funding sources. Brian shares insights from his venture, Collide Capital, which provides investment, coaching, and support to entrepreneurs lacking access to traditional networks.

The conversation highlights the importance of community, mentoring and education in empowering these entrepreneurs. Brian also discusses his involvement with the Takeoff Institute, which aims to develop future leaders. The episode underscores the critical role for entrepreneurship in value creation. Entrepreneurs develop better products and services and contribute to meaningful experiences for customers. Institutional support, such as venture capital, is essential.

Yet, only some have access to these resources, particularly those from disadvantaged backgrounds who may not be plugged into the institutional environment of university incubators and venture capital pools.

Key Challenges Discussed:

- Lack of access to networks: Many aspiring entrepreneurs from underprivileged backgrounds may feel disconnected from the networks facilitating access to funding and mentorship.

- Intimidation by networking: Networking can be intimidating, but it is not an insurmountable barrier. With the right coaching and support, disadvantaged entrepreneurs can find their way into these networks.

Brian’s journey serves as an inspiring example of how one can create value not only through business success but also by uplifting others and fostering a culture of entrepreneurship.

Resources:

Connect with Hunter Hastings on LinkedIn

Connect with Brian Hollins on LinkedIn

Knowledge Capsule:

Entrepreneurship as Value Creation

- Entrepreneurship creates value by providing better products and services for customers while also offering fulfillment and potential wealth for entrepreneurs.

- Early-stage startups require investment since costs can outweigh revenues initially, and many entrepreneurs lack access to institutional venture capital.

- Not all entrepreneurs have access to institutional funding sources like venture capital, especially those not part of exclusive networks like university incubators.

BLCKVC Initiative

- BLCKVC is an organization aimed at helping people of color access the venture capital ecosystem, guiding them through the fundraising process, and fostering inclusion.

- Minority founders face challenges in accessing venture capital. Institutions traditionally overlook minority founders,, but with proven success, capital flows to diverse ecosystems will increase, promoting diversification in investment portfolios.

Networking Challenges for Entrepreneurs

- Many entrepreneurs feel disadvantaged because they are not part of established venture capital networks.

- Brian acknowledges this is a real challenge but believes it can be overcome.

- Venture capital firms tend to rely on pattern recognition, favoring entrepreneurs and business models that fit past successful archetypes, often making it harder for those outside traditional networks.

Introduction to Collide Capital and Its Focus:

- Collide Capital is a venture capital firm focused on providing investment opportunities to entrepreneurs who historically lacked access to such resources.

- The firm emphasizes identifying and supporting underrepresented founders and entrepreneurs.

Barriers for Entrepreneurs:

- The common barriers entrepreneurs face, particularly those from marginalized or underrepresented groups include a lack of access to networks, mentorship, financial resources, and knowledge about scaling businesses.

- Businesses can now generate substantial revenue with fewer resources and less bureaucracy by automating processes, reducing overhead, and leveraging technology.

Impact of Mentorship and Coaching on Entrepreneurship:

- The role of mentorship, support, and coaching in the success of businesses, particularly startups.

- The importance of guidance, beyond just financial investment, in helping entrepreneurs navigate challenges, avoid common pitfalls, and grow their ventures sustainably.

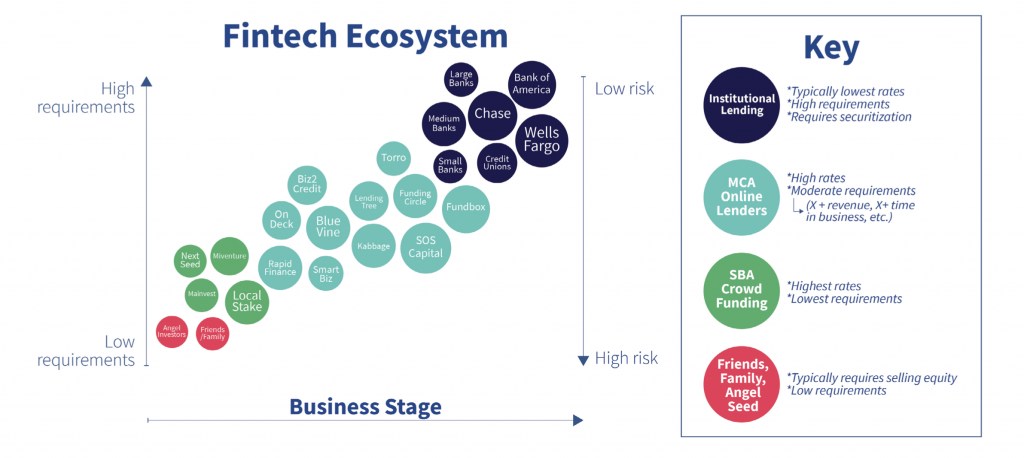

Deinstitutionalization of Finance Through Technology

- Fintech, blockchain, and other technological innovations can potentially reduce the need for traditional financial institutions.

- In this vision, financing could become decentralized, with direct access to capital through apps, lowering entry barriers for entrepreneurs.

- Technology, especially the internet and online platforms, provides access to information and opportunities that were previously unavailable.

- This democratization allows people from diverse backgrounds to gain knowledge and build businesses that would have otherwise been out of reach.

Entrepreneurial AI as a Thought Experiment

- This concept envisions AI handling the operational aspects of entrepreneurship, from supply chain management to fundraising. Although it’s speculative, this thought experiment explores the possibility of AI supporting entrepreneurs in scaling their businesses with fewer resources.

- While AI can assist in various tasks, it still requires human guidance. Entrepreneurs need to have experience or knowledge to instruct AI effectively, suggesting that AI alone cannot replace the expertise needed to scale a business successfully.

Takeoff Institute and Building Black Leaders of Tomorrow

- The Takeoff Institute is an initiative that provides black undergraduates with training, mentorship, and exposure to professional environments.

- The program aims to equip them with essential skills like cold emailing, managing up, and technical expertise, helping them break into elite roles in finance, consulting, and other industries.

- It also addresses the lack of diversity in high-level corporate positions by connecting students with successful black professionals.

Show Notes:

0:00 | Intro

1:05 | Differential Access

4:53 | Disadvantaged Entrepreneurs: How do they Get Started?

7:14 | Is Networking a Baseless Fear?

10:01 | Unique Business Models from Lived Experience

12:10 | Less Algorithmic, More Empathetic Approach

13:49 | Fund Zero: Collide Capital’s Stoy

15:28 | What is a Scout Check?

18:01| Collide Capital Investment’s Success Stories

21:45 | Better Entrepreneurial Culture: Raising the Community

24:40 | Education’s Role in Entrepreneurship

28:21 | Fellowship Language

28:58 | Future Access to Investment

32:00 | Technology’s Role in Entrepreneurship: Can Finance Become Less Institutionalized through Apps?

34:55 | AI as an Entrepreneur’s Operating System

38:00 | One-Person Billion-Dollar Company: Building Bigger Businesses with Fewer Resources

39:30 | Wrap-Up: Building Leaders through the Takeoff Institute