91. Curt Carlson on Innovation Champions

Austrian economics sees an economy in motion, perpetually renewing itself. Economic agents (firms, customers, investors) constantly change their actions and strategies in response to outcomes they mutually create. This further changes the outcome, which requires them to adjust afresh.

Entrepreneurs live in a world where their beliefs and strategies are constantly being “tested” for survival within an outcome these beliefs and strategies create. It’s complex.

Key Takeaways and Actionable Insights

One of the strategies required in this dynamic system is innovation: the enabling of new value propositions to customers, sustained by new resource combinations, new technologies, new go-to-market capabilities, new channels and new delivery mechanisms.

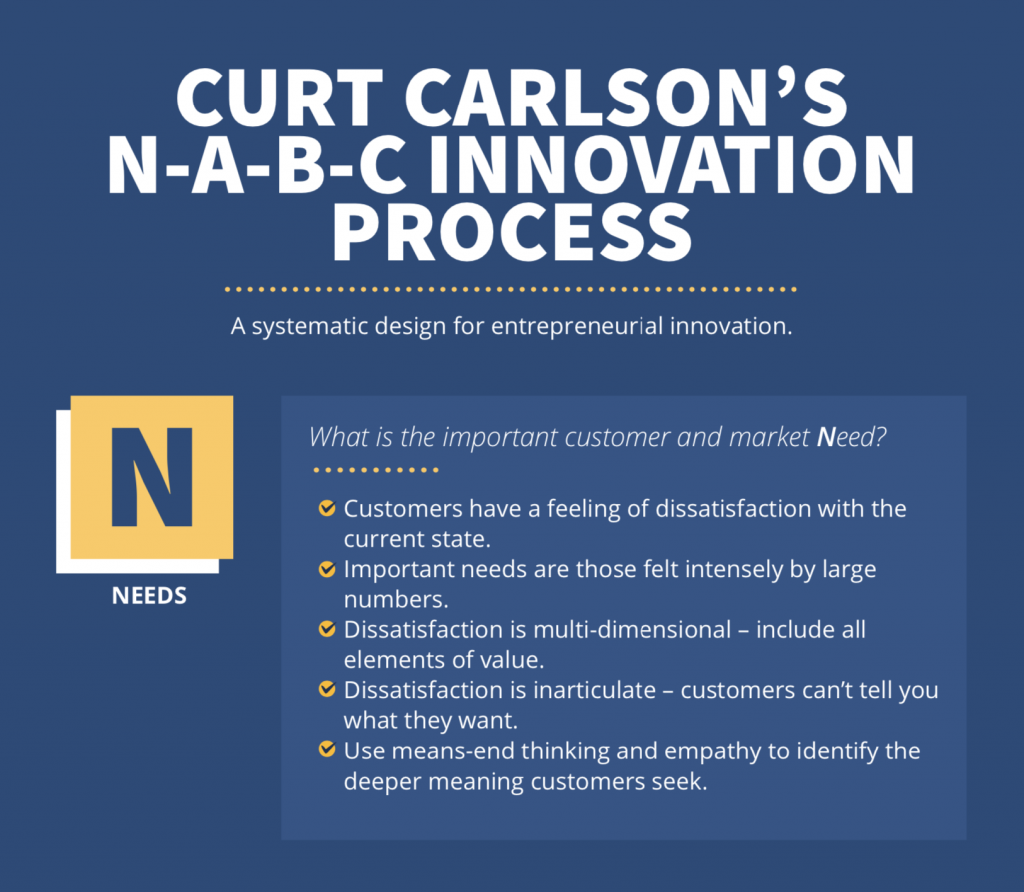

Innovation has often been characterized as presenting the entrepreneur with an unmanageable level of uncertainty. Curt Carlson challenges this idea and believes innovation can be predictable via the utilization of sound process, captured in his N-A-B-C method, which we explained fully in E4EPod episode #37.

In addition, Curt tells us in episode #91 that the right individuals can strengthen the process by acting as innovation champions. Here are their characteristics.

1. Originate a value proposition.

The route to value starts with a value proposition — accurately identifying a need and developing the appropriately differentiated approach with the right cost structure. Champions are those who can originate innovation projects with an energizing and inspiring proposition. They are customer advocates with creative capabilities. Champions can use Curt’s process map for guidance, or our own “Economics For Business Template” ().

2. Collaborate with a complementary partner.

Innovation is a team game, and it often starts with a partnership of two. Venture capital funds often look for a team of co-founders rather than on brilliant individual. A combination of an engineer and a marketer is a good one, but there are many more. The key is that the partner is complementary: different skills, different experience, same commitment and passion.

3. Build a team over time.

The benefit of complementary skills is not limited to co-founders or co-champions. As an innovation project evolves, the need for more skills and different experiences expands. A champion is able to add complementary skills via new team embers over time, while maintaining team cohesion and integrity.

4. Learn necessary value-facilitation skills.

Recruitment is not the only route to new skills for the team. The champion should be able to recognize skill gaps and fill them via their own learning. For example, mastering the interpretation of qualitative data from customer learning sessions is imperative but not intuitive. Champions work hard at gathering the data (listening and empathy skills) and processing the data (interpretation skills) to project possible future solutions (imagination skills). These new skills are learned over time.

5. Iterate with the team and in larger forums.

It is impossible to predict how an innovation process will proceed, and what twists and turns will be necessary. A champion is able to iterate the understanding of the need, the approach to solving it, the use of technology, and the management of costs. Change is constant not only in the world, but in the innovation project. Iteration can be conducted in the small team, but the champion should also seek larger — perhaps company-wide — forums for sharing and commentary. Everyone’s input counts. Champions don’t become too possessive of their ideas.

6. Champions exhibit enviable human values.

Project teams are often under stress. Deadlines loom, experiments fail, ideas clash. A champion demonstrates human value of trust and respect and integrity that bind teams and projects together. People want to work with champions.

7. Champions take organizational responsibility.

All innovation projects are fraught with risk and uncertainty. Some will fail. Others will take unexpected turns. When the unwanted or unexpected happens, a champion takes responsibility and does not try to deflect blame to exogenous factors. All decisions are subjective, and champions take ownership of their decisions.

8. Champions persevere.

Innovation project timelines can be long. Curt described some that took 10 years or more (like the development of Siri, which eventually became associated with the iPhone4). Despite barriers that might seem insurmountable, and setbacks that might feel humbling, champion s keep going no matter what. They are inspired, and inspirational to others.

9. Champions succeed.

Success is not a behavior or a characteristic, it is an outcome. Nevertheless, with the right process and a good team, champions succeed repeatedly.

In our hyper-competitive world, without a champion success is not possible. The only viable path is to aspire to be the best at what we do. That starts and ends with someone committed to success — a champion.

Additional Resources

Check out Curt Carlson’s HBR article, “Innovation for Impact” (PDF): Click to Download

Curt’s website is PracticeOfInnovation.com. Click on “Innovative Indices” to see how to assess the innovative potential of your firm and projects.

“N-A-B-C Innovation Process” (PDF): Click to Download

“Curt Carlson: There is a Systematic, Repeatable Process to Generate Customer Value”: E4EPod episode #37