David K. Hurst: The Organic Approach To Strategy And Business Management And The Ecological Business Model.

Podcast Transcript: Conversation With David K. Hurst; September 8, 2020

Listen to the full episode here.

Hunter Hastings:

David, welcome to Economics for Entrepreneurs.

David Hurst:

Thanks, Hunter. Good to be with you.

Hunter Hastings:

We’re greatly favored to have you with us today. You’re a deeply experienced and highly accomplished business person. You’re now an educator and an advisor, and that’s at the highest level such as the Global Peter Drucker Forum. We’re fans of Drucker’s work here. You’re an author, you’re a writer, and you say you’re a reflective practitioner. You make sense of experience and you reach out for theory where it can help you make sense of experience, and we very much support that way of looking at business in the world. Sense-making begins and ends and practice. Theory can help rationalize it, and that’s what theory’s for so we support all of that approach.

Where I’m going to start, David, is you’ve said that a lot of how we’re traditionally taught to think about business and management is wrong. That could be formal teaching in business school or it could be business books or it could be other forums. So let’s start there. Let’s understand what’s wrong with the way we’ve been taught to think about business.

David Hurst:

Well, thanks, Hunter. Not quite so much wrong as totally inadequate to the requirements of the situations in which one finds oneself in business. I should say, by way of background, that I was born in the UK but actually grew up in South Africa, where I had all kinds of unusual experiences, and had an opportunity in the early ’70s to go to the University of Chicago and study finance on their MBA program, which I did.

I emerged from Chicago believing, or at least accepting, the basic assumptions which lay behind business education at that time, which was heavily influenced by what I came to understand was neoclassical economics. That is, it believed in greed as the primary motivation. It was all about individual self-interest and utility maximization, I think, was the word. It was heavily rationalistic in that it believes that we ought to behave like little mini scientists with everything based on evidence and data and then lastly, the focus was very much on equilibrium, that markets were self-equilibrating and that the natural condition in organizations was stable. Stability was the norm and change was something that you had to manage and that if things went awry, it was mainly because you weren’t following standard procedures. Management was essentially about allocating resources… It was nothing about innovation… and making sure things ran in a steady, linear, rational fashion.

David Hurst:

When I got into the real world, I found that these principles were, well, wrong, that people acted for all kinds of reasons that had nothing to do with their own self-interest. Sometimes, there was greed, but often there wasn’t. That people were not rational certainly in the mini science sense, and that the economy and businesses in general were far from stable. In fact, whenever I joined a business, it seemed to get into trouble. At first, because of my education, I thought it was me. Obviously, I’m doing something to destabilize things. But then I realized that’ of course, the linear, stable, rational model is the way academics think businesses ought to run, if only they would listen to them, and the fact you can’t run them that way because the world is nonlinear. It’s dynamic. It’s not rational because we’re not just lone individuals. We also work in collectives, in communities. And of course, that stability and change are intrinsically entangled with each other.

David Hurst:

And I went through one particular experience. This was, by now, in the early ’80s and I had emigrated to Canada, which is where I currently live. I started working for an industrial distributor as a financial planner, I think I was. Within a few months, we were put in play. We were a public company on the Toronto Stock Exchange. We were put in play by a greenmailer… Greenmailers, at the time, if you remember, were folks who came in and bought the stock and promised to act up unless they were bought out, hence the term of greenmail… which triggered us into a takeover play and a leveraged buyout with far too much debt on the eve of the great recession of 1982, which, if you remember back that far, was characterized by very high interest rates up to 25% plus and a sharp drop in demand for everything.

David Hurst:

So we were acquired on the eve of this recession by the son of a brilliant entrepreneur. Very wealthy. He had made two fortunes, so one in steel fabrication and the other in real estate, and we were acquired by his son. His leverage buyouts borrowed from our bank, who was only too eager to lend money to such a wealthy family. However, it turned out to be rather more complex. The family was highly dysfunctional. The son had not got permission from his father, and he hadn’t even discussed it with his two brothers who were joint shareholders of the takeover vehicle. They read in the papers that they were each going to be on a hook for about a hundred million personal guarantee and they were not amused.

David Hurst:

Over the next six weeks, we were swanned over by all their advisors. They all had a different [inaudible 00:07:09] of accountants and consultants and the like. It turned out, far too much had been paid for us and the family… In fact, the father sat on the board of our bank and told the bank to withdraw the loan, which they did, and so we found ourselves looking to finance… It was only 300 million dollars but back in the 1980’s that’s probably the equivalent of about a billion today… just as the 1982 recession hit. We went insolvent overnight, but not before another bank agreed to finance it just before everything fell apart. We found ourselves insolvent but owing the bank so much money, it was their problem, not just ours. That was one of the lessons I learned, that either you have to owe the bank very little or a whole lot. Otherwise, you have a problem.

David Hurst:

So, what were we to do? We were merged with the purchaser’s steel fabrication business which, as far as we could tell, had not made a profit in about 20 years. Budget was a place where you rented a car. The whole thing was run in a very informal fashion with about 700 people reporting to the loan entrepreneur. Quite chaotic. We ended up with about 19 different challenges that didn’t fit into anyone’s job description. One challenge, for instance, was that the fabrication company was building a bridge across the Mississippi. A huge bridge. In fact, it was the first stable-cayed bridge to be built across the Mississippi to carry interstate. They were six months late. They were being sued by the state of Louisiana for liquidated damages and the cables, which were polyethylene-coated steel made in Switzerland, were rusting.

David Hurst:

You get that kind of problem, what do you do? We formed small, informal teams of folks we felt we could trust. They had to be generalists because we didn’t have any cable-stayed bridge-building specialists in our business, and the times were frantic. We formed these 19 teams and set them off to just find out what they could discover on the grounds. They went out to Louisiana. They went all over North America to look at projects and plants and activities of various kinds that were in deep trouble.

David Hurst:

I can’t tell you how different this was from our organization before the crisis. Our steel distribution business, or industrial distribution business, had been conventionally organized with a hierarchy and extensive planning. We had three books of manuals on how the world should work. People went through career paths and they had job descriptions. The usual paraphernalia. And of course, that proved totally inappropriate for our conditions. We needed small. Agile is the current word today. At this stage… I’ll cut a long story short but over the next four years, we were turned upside down. The hierarchy receded into the background. It didn’t disappear, but it went into the background and the teams… We call them hunting teams… came to the foreground. We were turned inside out because this was no longer about individual self-interest, which the formal hierarchical organization cases do. This was about survival of the community. It was survival of organizations. It was different communities all over the countries of Canada and the States. We turned inside out. We became much more concerned with community than we were with individual success or failure.

David Hurst:

It took us four years. We went through the fires and eventually came out the other end with new owners and new bankers, and recapitalized business which emerged just in time to benefit from the boom of the late ’80s. I think we went into the crisis with 700 million dollars in sales and about 4,000 people. We came out with 220 million dollars in sales and 700 people. And then over the next five years, we grew to over a billion dollars in sales, a combination of economic recovery and acquisitions.

David Hurst:

Being a reflective practitioner, I sat down at the end of this and tried to make sense of what had happened because it’s quite clear the frameworks I’d learned in business school just weren’t up for the task and I wanted to understand why. I found a framework, initially, in Daoist philosophy, yin-yang philosophy. It seemed to us that there were two dimensions or two processes going on in parallel in the organization. There was a hard, productive yang process which had always been in the foreground and a softer, creative, informal, collective yin process in the background. When we hit the crisis, the two had reversed. The yang had gone into the background and the yin came to the foreground. I didn’t call them yin and yang in the article I wrote. I called them boxes and bubbles, boxes being the formal box structure which productive, large-scale organizations end up using, and bubbles were these soft, informal teams that we formed at a moment’s notice. They formed easy coalitions with each other and when they did the job, they burst. They disappeared and went back into the mixture out of which new bubbles could come.

David Hurst:

I wrote the article, I sent it off to the Harvard Business Review, never expecting in a million years they would publish it, and they wrote back six weeks later and said, “We love it. We’re publishing it almost without editing,” and it was published as Of Boxes, Bubbles, and Effective Management. It became a bestseller at the time. It attracted some interest from academics, particularly heterodox academics, academics who were not in the mainstream who taught greed, rationality and equilibrium.

David Hurst:

There was a young PhD candidate by the name of Brenda Zimmerman at York University, it was then. She had lost her organization she was doing a case study on for her thesis, and we made a presentation at the university and she came up afterwards and said, “Would you be interested in letting me use your company as a study for my focus on using complexity theory and chaos theory to understand how organizations really work?” And I said, “Well, sure. Let’s do that.”

David Hurst:

She introduced me to complexity theory, to systems thinking. I’d always been into systems thinking somewhat, but this was a different take on systems thinking. What had struck me was that it had taken a great crisis for this change to take place. That fitted with my career experience where organizations went through relatively long periods of apparent stability and then it was interrupted by a crisis of some kind, just like the pandemic we’re currently experiencing. I couldn’t find any theory to support this, and I looked around for other organizations that change in times of crisis and of course I found them in nature.

David Hurst:

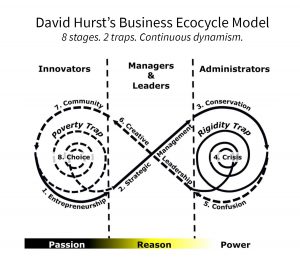

Nature uses crisis to shake up the established order and to renew its systems. In particular, Brenda Zimmerman introduced me to the writings of Canadian ecologist by the name of Buzz Holling, and Holling has something he calls an adaptive cycle, which he used to understand ecosystems like forests, for example. Just to explain it to you with a graphic, it’s an infinity-shaped loop. A mobius strip, if you prefer.

David Hurst:

Yes. Absolutely. Well, I will try and do it as graphically as possible.

David Hurst:

You have this infinity-shaped loop and you can begin anywhere on it. But for argument’s sake, let’s think about a forest, particularly a lodgepole pine forest, the kinds that you find in the Rockies up and down the West Coast of North America. The lodgepole pine begins in an open patch where there’s equal access to sun and rain and everything grows. The initial growth in that open patch, and we’re in the bottom left of this figure eight lying on its side, are of course weeds. They are the entrepreneurs of the natural world or certainly the flora. The weeds are the first movers. They come in. There’s equal access to sun and rain. Everything grows like crazy and there’s no competition until they start bumping into each other.

David Hurst:

At that stage, in order to survive in an environment where there’s emerging competition, you got to start to build economies of scale, and the next what appears in this ecology are the shrubs. The shrubs sink a root to get to the water quicker. They put up a branch and leaves to get to the sun and cast shade over the weeds and they outcompete them. They’re more efficient in the way they use resources and they start to build scale.

David Hurst:

And so you see this forest succession, as it’s known, where the weeds are supplanted by the shrubs and then the shrubs are supplanted by the fast growing trees, which might be aspen, say, in the mountains, which are very fast growing trees and they have even greater economies of scale. They grow higher and they sink their roots deeper and they actually form a community with each other. Their roots entangle with each other and they outcompete the shrubs. And then eventually… And this is idealized. It varies from system to system… the fast growing trees are supplanted by the conifers, in this case, the lodgepole pine. It grows straight and tall, gets to sun first, shades out everything else and grows beautifully. At that stage, it’s a mature forest.

David Hurst:

Ecologists used to think that this was the end of the process. It certainly marks a slowing down of the process because now the ecology is populated with these tall conifers, these tall lodgepole pines, but change has not stopped. It turns out that the lodgepole pine is a self-pruner. As it grows up, it drops its lower branches on the ground. Then eventually, after about 30, 40 years, depending on the climate, it gets attacked by insects like mountain pine beetle that actually kill it and creates standing firewood. As a result, you get fires in the forest when lightning strikes because there’s so much fuel ready to burn. The fire clears away the fallen branches and the dead trees, recycles their ingredients for the next generation and of course, now the young big trees survive and carry on to last a little longer.

David Hurst:

I suddenly thought, “Wow. This is interesting front loop.” By now, we’re at the top right. We’ve grown in scale. The vertical dimension is scale. We started off small and fast weeds and we ended up big and slow trees, and then the forest had to renew itself by burning the obsolete, decadent growth to create the space into which new growth can come. At that stage, it drops down into the bottom of the right-hand side and you start to build a new community as you travel up to the top left, which is essentially community out of which new growth will come, and so you go around and around this infinity-shaped loop with the forest existing for indefinite periods of time, once again depending on climate change and how fast everything’s warming and changing.

David Hurst:

But I suddenly thought, well, this is how an ecosystem survives and it’s [inaudible 00:22:25] that in the 1880’s when the US Park Service got responsibility to look after the parks, their initial effort was in fact to put out fires in the forest. Their mandate was to make the trees big and beautiful and obviously, fires destroyed trees. They thought, “Well, we need to stamp out fires. We want big, beautiful trees.” And they did that very successfully from early 1900s on until ’60s and ’70s, at which stage they started to get fires that they couldn’t put out because it turned out, by trying to keep the forest too stable, you were interfering with the natural process of destruction and renewal. You could keep small fires out but eventually, you were building fuel on the ground and you’ve got fires you couldn’t put out.

David Hurst:

In 1988, they had that huge fire in Yellowstone. I read about the story and I thought, “Oh, wow. Isn’t this what happens in our large-scale corporations as well as government, is by trying to keep them too stable, we actually set them up for eventual crisis?” All of a sudden, I had a sense-making model of how the world worked because it works not only in natural ecologies, but also in human systems as well, and certainly in organizations.

David Hurst:

At that stage, a sort of revelation came over me. I’ve been a closet academic and I find I could read stuff and understand I’ve never been able to understand before like sociology and philosophy and all these big things. I start to set out on to an inquiry as to how does this all fit. What does it mean? How did the business schools get to teach this totally inadequate model? What I discovered, of course, was that the period when the business schools adopted this model was the late 1950s. That was in the aftermath, of course… The World War had ended in 1945. The US had emerged victorious, the liberator of the West, the savior of mankind. They were the only large industrial economy that had not been devastated by the war, and of course with their generosity of the Marshall Plan and so on, the defeated Axis Powers were customers to rebuild their economies which had been totally devastated.

David Hurst:

When the business schools were reformed in the late ’50s… Because they were seen as really vocational training colleges. They weren’t seen as academically serious. When they were reformed, it was all about how to come up with systems to produce economies of scale, how to produce more of the same. The steel business, which I was on the fringe of and I understand a little bit, US Steel, for instance, was using open hearth furnaces in the early ’60s, and these were totally obsolete technology. Very inefficient, highly polluting. But of course, they had tremendous demand for steel for rebuilding the world and there was no reason to change. They were making money like bandits and there was growth. There was prosperity. I mean, even in the political debates today, we hear the ’50s and ’60s looked back on with great nostalgia when we had our story together. We knew who we were. If you were a blue collar without education, you could get a great earning job and have a home-maker at home and two cars in the driveway. It was the middle class dream.

David Hurst:

The theory that emerged was how to perpetuate this success. And, of course, then the story changes from there because as the ecological [inaudible 00:27:10] says, nothing lasts unless it is incessantly renewed. Japan and Germany rebuilt and when they rebuilt, they didn’t put in open hearth furnaces. They came back with electric furnaces. Scrap fed, which were far more efficient and cleaner and cheaper. They came back with new technology and all of a sudden, the story started to change. It wasn’t being able to produce more of the same. Now, you had to innovate. Of course, the whole notion here is that the organization structure required to run something with economies of scale, a very mechanical, machine-like, productive hierarchy, is very poor at innovation because those are exactly the dynamics that you’ve got rid of in the pursuit of efficiency, in the pursuit of low prices.

David Hurst:

It seemed to me that organizations needed a better balance. But the theory that business people use to support them in this productive model was of course neoclassical economics. They appealed to them to explain why it was all focused on greed, self-interest, why it was all about rationality and it was all about stability, keeping things the same. And it was at-

Hunter Hastings:

Now, I know you don’t have a dog in the fight, David, but our Austrian economics school believes the opposite of all those things. We believe in the flexibility and [crosstalk 00:28:56]-

David Hurst:

Well, of course, and that’s when I discovered mainly Hayek. Friedrich Hayek has been my guide and I know some Austrians don’t regard him has authentically Austrian. Ethnically, he’s Austrian but they don’t regard his economics… And in fact, his economics-

Hunter Hastings:

No, no, no, no. He’s a great Austrian economist. He wandered into some other fields later in life.

David Hurst:

Yes. Well, I actually liked his other fields. I think he had interesting things to say.

Hunter Hastings:

Well, he does.

David Hurst:

My favorite book of his is The Fatal Conceit, which was his critique of socialism and central planning and I’m with that, that the world is just too complex to do that.

Hunter Hastings:

Well, yeah. You’re a hundred percent right.

David Hurst:

But it seemed to me that that applied to the corporate world, the mini socialist structures. I mean, when I graduated from business school, the Fortune 500 were the sort of last refuges of Stalinist bureaucracy. I mean, that’s the way they work. People at the top were dictators, the word for it.

David Hurst:

They were central planners so Hayek’s critique applied to them as well and of course, I was very keen to make them much less rigid. Now, I think there’s very real limits as to how innovative you can make these large-scale organizations. Nature does not rely on large trees to reinvent themselves. She sweeps them away with flood and fire and wind and pestilence and then recycles the ingredients for the next generation.

Hunter Hastings:

It’s an interesting discussion, David. There’s nothing inherently wrong with scale as size itself but as you point out, that becomes bureaucratic, sclerotic. It’s about retention, not innovation. We shouldn’t be thinking in antitrust terms of scale. We should be thinking in effectiveness terms. It just doesn’t work anymore.

David Hurst:

Yeah, it certainly gets to that stage. Well, I’m not entirely sure we can dispense with antitrust because the temptation… In fact, when I took Holling’s adaptive cycle and applied it to human organizations, of course people can think and move and trees can’t do that. I had to add some extra dimensions. The extra dimensions, I took the infinity loop and the left-hand side, I called all about passion. I said, “Enterprises are conceived in passion. They are born in communities of trust and practice.” That’s how the first stage is one of passions.

David Hurst:

And then, most of them actually die in that stage. They’re stillborn. But those that come up with a recipe for success, something that works, they move into the stage which is reason. They start to connect, cause and effect, “This produced a good result. This is our segment. This is our product. This is where we should be,” but maybe some strategic pivots at that stage as they calibrate where they’re at, and they start to get into the rational mode. And that’s fine. The rational mode is there, but it’s not universal.

David Hurst:

And then they grow like crazy and it’s really about more of the same. This is the American economy of the ’50s and ’60s: tremendous growth, organizations going global, growing like crazy. And then they get to the limits that the market is just about as big as we can serve. They start to think about making acquisitions. They start to head towards essentially thinking like monopolists or oligopolists. They want to get more control of the market.

David Hurst:

The third stage on the right-hand side of our infinity loop is power. This was something that we never really talked about in business schools. In fact, I felt the business schools used rationality to cloak power. This is certainly what I found in practice when I went out into the real world and worked for some large organizations. You would be asked to look at an acquisition and you would come up with some spreadsheets showing possible impacts based upon various assumptions. And then particularly with the emergence of the computer-based spreadsheet where you can produce these things very quickly and as many as… would like, the boss would come and say, “Well, I want to do this deal so find me some assumptions that make it work.” Instead of getting evidence-driven strategy, you got strategy-driven evidence. It was totally inverted. The process was actually a process of power. The boss is saying, “This isn’t what I want to do. Find a way to do it,” and we had left reason. We were now in the power phase.

David Hurst:

I’m afraid that this is where everything ends up. It ends up in structures of power. It ends up with elites, in the case of the political process. Michael Porter has just written a very interesting book on what he thinks has happened to the American economy and that essentially, it has got stuck in what I would call a power trap. There are traps, whirlpools at each end of the infinity loop. On the right-hand side is a power trap, rigidity trap, a competency trap. This is not a moral judgment. It’s just you’re very good at these things. Why would you change?

And then on the left, of course, it is the entrepreneurial trap where you’re trying a zillion things and nothing is working and nothing wants to break out and [inaudible 00:35:33]. Hence, to get back to the monopoly thing, we have to be very wary… And this is true at the political level as well.. of getting caught in power traps where people, it’s all about getting elected if you’re a politician, and it’s all about keeping your job and rationalizing what you’re doing using neoclassical economics. And-

Hunter Hastings:

I want to make the leap, if you don’t mind, from that scale and that economy level to the ecological mindset for the business manager today. Because you’ve said some really fascinating things about how to manage in this manner that you suggest. Let me mention one, which is… You say that act and learn is the right way to use experience as a source of input. You say, “Act ourselves into better ways of thinking rather than think our way into better ways of acting,” which is a very impactful phrase. Tell us about acting ourselves into better ways of thinking.

David Hurst:

Exactly. I had the opportunity earlier in my business career to work with entrepreneurs. The situation was I was with a very acquisition-minded industrial conglomerate. They would snap up small entrepreneurial businesses, and they would put me in for three months to work alongside the entrepreneur who had sold them the business and understand what was needed for it to be folded into one of our larger units which would then pursue economies of scale. I mean, classic acquisition to build scale kind of process.

David Hurst:

I would sit alongside these entrepreneurs and see how they worked. I mean, they weren’t applying any abstract principles. In one case particular, I remember was a guy… He was Austrian, but not an economist. He was a tool and die maker in Austria and he had come out to South Africa and he had set up a tool and die business to make stampings and drawings… I’m talking metal drawing… fuel tanks, in fact, for the automotive industry in South Africa. This guy was a wizard on the technology of stamping and being able to do deep draws in one draw that his competitors took five draws to do and so on. It was just know-how, practical knowledge, and everything really moved from there.

David Hurst:

He wasn’t dealing in abstractions at all. It was all about practice and things emerged on the shop floor, “Oops. Okay, so that’s interesting.” He was continually experimenting, tinkering, and he was hugely successful because he had this extremely efficient effective process. And he was not intellectual in the remotest. If you tried to ask him, “What principles are you operating by?” he wouldn’t be able to tell you and that was okay. It’s the power of practice and that the actions come first and the words come later.

David Hurst:

As I see any particular enterprise and I put them on my infinity loop, you got traps on each side. You got the power trap where you get really stuck, particularly if you’re a public company. Going public for me is absolute watershed in this process. It pushes you to the top right of the infinity loop, gives you a determined shove there because all of a sudden, it’s about finance and short-term outcomes and quarterly earnings and, I mean, you’re addressing an audience whose interests are very different from what they were when you were an entrepreneur, small-scale, bottom left.

David Hurst:

There’s that trap on the right-hand side and then there’s the left-hand trap which is the entrepreneurial trap, which is trying a zillion things and nothing’s work. And I said, “Well, clearly, there must be a zone in between where you’re big enough but you’re not falling into that success trap power trap, but at the same time, you’re got a program and innovation that you’re working on that’s producing enough innovations to come into the business and keep people creative and thoughtful and so on.” What I saw was this space, this zone in between which was, on the left-hand side, it was all about acting your way into better ways of think and on the right-hand side, it was about thinking your ways into better way of acting.

David Hurst:

The two are melded together. It’s a dance, if you will, between the two sides. You’re trying to weave in the middle here, balancing in a very dynamic way, the way nature does in the forest. It’s continued balance between new patches with new growth and the next generation coming in and the old patches, the mature businesses and operations and products that are giving you your daily bread. And you need them both. It was this weave which was important.

Hunter Hastings:

David, another phrase… Tell me if it fits into what you’ve just described… that I read in your book which was really also impactful is managing like a gardener analogy, your ecological analogy. You say, “Help things happen rather than make things happen.” Tell us about that mindset. How does that work?

David Hurst:

Exactly. The way you came out of business school in the 1970s was thinking about the job of management like an engineer. You had this machine which required to be maintained, lubricated, fixed, parts replaced sometimes, but it was essentially a machine, a smooth running machine, and you think like an engineer. That’s okay in certain circumstances. There are machine-like aspects to enterprises. But taken to the limit, if that’s all what you’re doing, you’re going to end up in the power trap on the right-hand side.

David Hurst:

On the other hand, on the left-hand side, you’ve got wild nature and it’s “Let everything hang out.” That clearly is very much hit or miss and you can… It works at the ecosystem level. It works at the Silicon Valley level, but it doesn’t work well at the enterprise level. I see the manager in between as a gardener. A gardener has engineering aspects, but they also have wilder aspects to them. The gardener creates the conditions in which, in the case of enterprises, people can grow. They grow people. That’s what it’s all about. I see this gardener as the one being able to conduct this dance, this weave between mechanical… I mean, sometimes you need to dig up soil and replace it. You may need to tear down existing plants and put them on a bonfire and burn them, break out the chainsaw and saw. At other times, you need to supply structure, lattice on which they can be trained and pruned and all that kind of stuff. The gardener seemed, to me, to capture this duality to the manager’s task.

Hunter Hastings:

Good, and then one other thing that you’ve said is that this chasing the numbers, making the numbers, that’s a little bit of a challenge or problem. You said, “Non-measurable results are a big part of the solution.” Which particular non-measurable results are you thinking about?

David Hurst:

Well, as we said at the onset, I’m involved in the Drucker Society in Europe. I like Drucker’s stuff and of course, he was Austrian. He had the same duality to him. But of course, when he began his writing, it was in a time when management was still very intuitive. The practitioners and the business schools had nothing but old timers telling war stories. Peter Drucker emphasized the possibility for rationality in management. He was leaning towards that [inaudible 00:45:27] because that’s what it required.

David Hurst:

In the process, however, he acquired a reputation and had attributed to him phrases like “If you can’t measure it, you can’t manage it.” It turns out that this is completely wrong. He not only didn’t say that, he actually said the opposite. He said that a lot of unmeasurable things which are absolutely valid and are absolutely critical… Because he says measurement is always about the past. It’s always about what happened. He says, “The things that really matter are the unmeasurables that refer to the future.” The example he gives is the ability of the enterprise to attract young, high motivated people. He said, “If you can’t attract these people, eventually it’ll show up in the numbers, but it’s not something you’ll see in the numbers right now because it hasn’t happened yet. It’s straws in the wind.”

David Hurst:

For me, this was an entrepreneurial sensibility which I think was absolutely critical. In the steel delivery business, I can recall… Not very often because it was very early… I’d get up at 4:30 in the morning, they put an [inaudible 00:46:49] seat in the passenger side of a steel delivery truck and I’d go out with the driver delivering steel to your customers. And you think, “Wow, Senior Manager, what are you doing that for?” Well, it’s interesting because this guy ends up in the customer’s yard and who else is in the customer’s yard? Why, your competitors. What are they carrying? What kind of product do they carry? And oh, by the way, how busy does the customer look? Is their plant busy? Hey, have you talked to the foreman and you ask “How business?” What do they say? In turns out that your drivers are potentially capturers of these unmeasurable factors because you’re not going to get any metrics on whether your customers are busy, but drivers are eyeballing it on the daily basis.

David Hurst:

How do you capture that information? How do you turn your driver into an entrepreneur? Thinking like an entrepreneur, what does this mean in terms of our priorities, the kinds of results we’re trying to achieve? In the steel business, which the economists say is a commodity business… They’re quite wrong in that. In fact, you can only make money in the steel business if you don’t think of it as a commodity… it’s all about having a thousand people doing one percent a little better. There’s no great technology. There’s no product breakthrough, but it’s all about being able serve the customer, adding knowledge to the transaction so you’re not just selling commodity, you’re selling solutions to problems, essentially.

David Hurst:

That all is based upon those nonmeasurable aspects of getting everybody in the organization talking to each other about what’s happening, about what they’re seeing every day, because that’s where it’s happening, on the ground. This is all a part of acting our way into better ways of thinking, getting ideas, seeing the opportunities emerge out of what we’re doing, out of the action.

Hunter Hastings:

Good. Well David, we’re going to have to wrap up for time reasons. We got a lot more to talk about, and maybe we’ll do it on another occasion. I don’t want to put you on the spot, but think about our core listeners here. We think of what the government derisively calls small business but it’s actually the entrepreneurial business and the growth businesses. If you think of businesses up to a thousand employees, that’s 99.9% of all the employing business in the USA. But it’s not Apple and it’s not Amazon and it’s not General Electric, obviously. Can you help our business owners and managers think about how best they can start applying this manage like a gardener and act and learn kind of approach?

David Hurst:

Well, I think it needs a change in overall government policy, which has tended to favor the large-scale. I’m not a great fan of the leverage buyout people, now called private equity or whatever you want to call them, because I think it’s actually a recipe for liquidation of the business. The shareholder value movement which, once again, came out of a crude interpretation of Milton Friedman has, I think, been extremely damaging to the American economy. You’ve got large oligopolies. It’s led to a focus on a bloated financial sector. Financial sector is, in my view, dysfunctionally large. You’ve got lot of brilliant minds going off to Wall Street when they should be on Main Street. I mean, that’s the life blood. That’s where the jobs are. That’s where the meaning is. That’s where the stories are. It’s all about story.

David Hurst:

If you worked in… Your family worked in a furniture factory built around High Point, North Carolina, you could have had three generations there. Send it off to China, you’ve destroyed an entire family story, not only just the earnings, it’s the meaning of what they do every day and that’s in the local work. I see them as the vehicles for rebuilding community, and they need a lot more help from the federal government.

David Hurst:

This other aspect of developing people, growing people, private companies, I think, are in the best position to adopt this ecological model because they’re very leery of debt, which is a real issue when you get to the public companies, and they discourage careerism where every two years, the manager moves on to a new assignment. I think this is all about building a community of trust and practice. I think that’s absolutely critical.

Hunter Hastings:

Good. Well, that’s a little bit of what we’re trying to do. David, thank you for today. It’s very inspiring and instructive to listen to you talk about where business management thinking has gone wrong and some ways to think about it in a better way. We left a lot unsaid, so I hope I can persuade you to come back again, maybe in a few weeks and we’ll talk about some of the things we didn’t cover. But today was magnificently helpful for us and I thank you very much.

David Hurst:

It’s a great pleasure, Hunter, and thank you for the invitation to be with you and your community.

Leave a Reply

Want to join the discussion?Feel free to contribute!