This Is Value Entrepreneurship – The Business Method Fueled By Entrepreneurial Economics.

Entrepreneurship is the business driver – of revenue and growth, of the customer base and customer loyalty, of innovation, of cost reduction, of everything about business that constitutes success. It’s true of businesses of every scale – every firm must be entrepreneurial to succeed.

Value is the purpose of entrepreneurship. On the Mises Institute Economics For Business (E4B) website you’ll learn deep insights about value – that it’s not a thing but a feeling, that it’s the outcome of a learning process, that you can’t put a price on it, but people will pay for an expectation of value. There’s a lot to learn about value.

Combining the two in Value Entrepreneurship provides you with an understanding and a toolset to pursue new value for customers at every scale, in every firm, via every project, process and job. Value Entrepreneurship is the business system fueled by entrepreneurial economics.

Let’s first examine and prepare for entrepreneurship. Entrepreneurship is action. While MBA programs may focus on strategy and planning and finance, E4B’s alternative approach emphasizes action. Entrepreneurial action can be broken down into two components – the decision to act and the action itself.

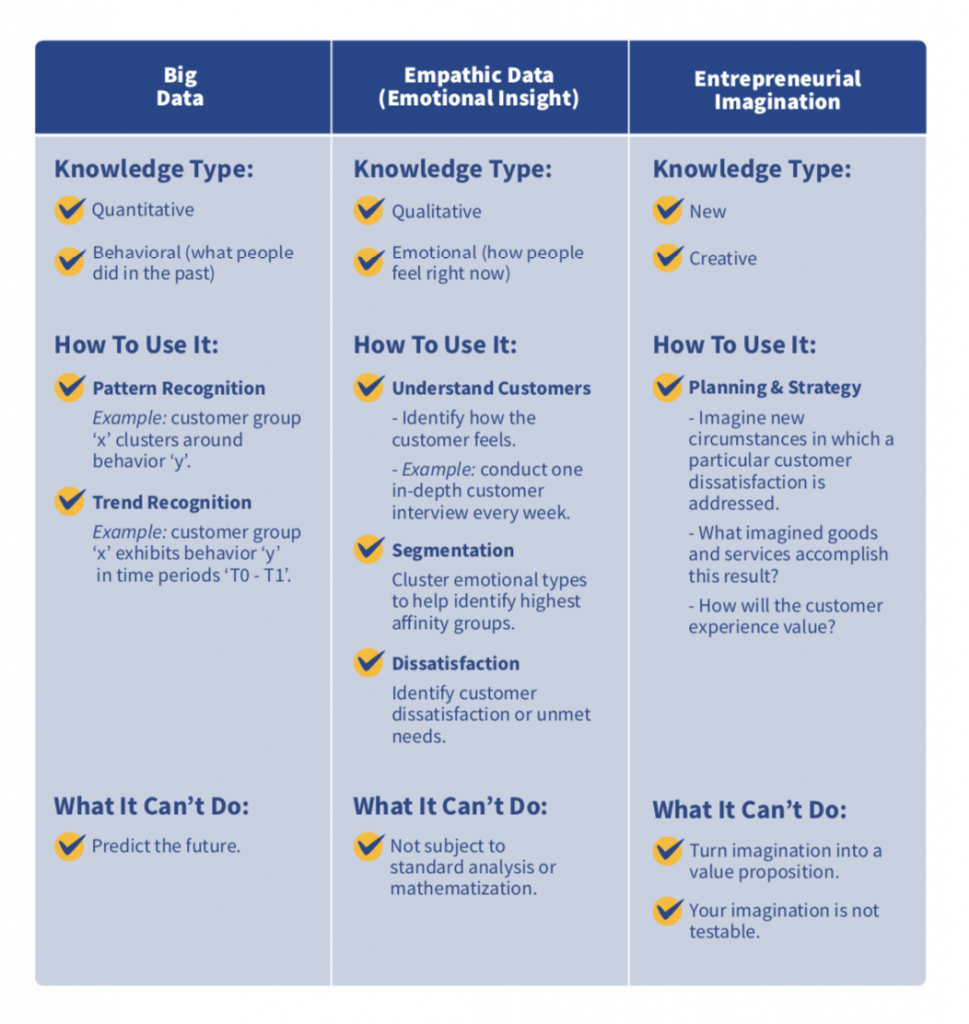

The decision is a hypothesis. There is more uncertainty in business than can ever be resolved. You are never certain. The most you can expect is to narrow down your choices of possible actions to a small number. You develop a hypothesis of what could work based on two inputs. First, an analysis of whatever information or data is available to you that tells you something about prevailing market conditions and constraints. And second, the synthesis of your data-based conclusions with your instinct and intuition, your assessment of dynamics and what might change in the future, as well as your creativity and ideas. From analysis and synthesis, you generate hypotheses of all the things you could do that are aligned with your intent, and choose as many of those as you’re capable of implementing – that’s your capacity, which might be governed by available funding, staffing or capital goods such as your AWS service agreement.

With the decision made, you act. Decisions are hypotheses and actions are experiments. The purpose of an experiment is to generate learning. Find out what works and what doesn’t, so that you can do more of what works and abandon what doesn’t. If you run as many experiments as possible, the fittest business strategy will emerge. Complex systems theory refers to this process as explore and expand. That’s what entrepreneurship consists of: exploration followed by expansion.

We learn because action generates interaction – with customers, retailers, markets, competition, media, and the entire business ecosystem. Interaction, in turn, generates a feedback loop. Customers buy or don’t buy. They enjoy their experience, or they don’t. Or, most likely, they partially enjoy it but there are some drawbacks that the entrepreneurial business can respond to and rectify if they can properly gather the right knowledge.

That brings us to the second part of Value Entrepreneurship – the value part. We just referred to the customer’s experience. That’s what value is – an experience, subjectively felt and evaluated by customers. Value is formed and experienced entirely in the customer’s domain. As you’ll appreciate as you enter more deeply into this way of thinking, the customer is the driver of your business. Customers are the sole determinants of business success or failure. They determine what gets produced by buying or not buying – by not buying, they ensure that production stops and business resources are redeployed to new uses.

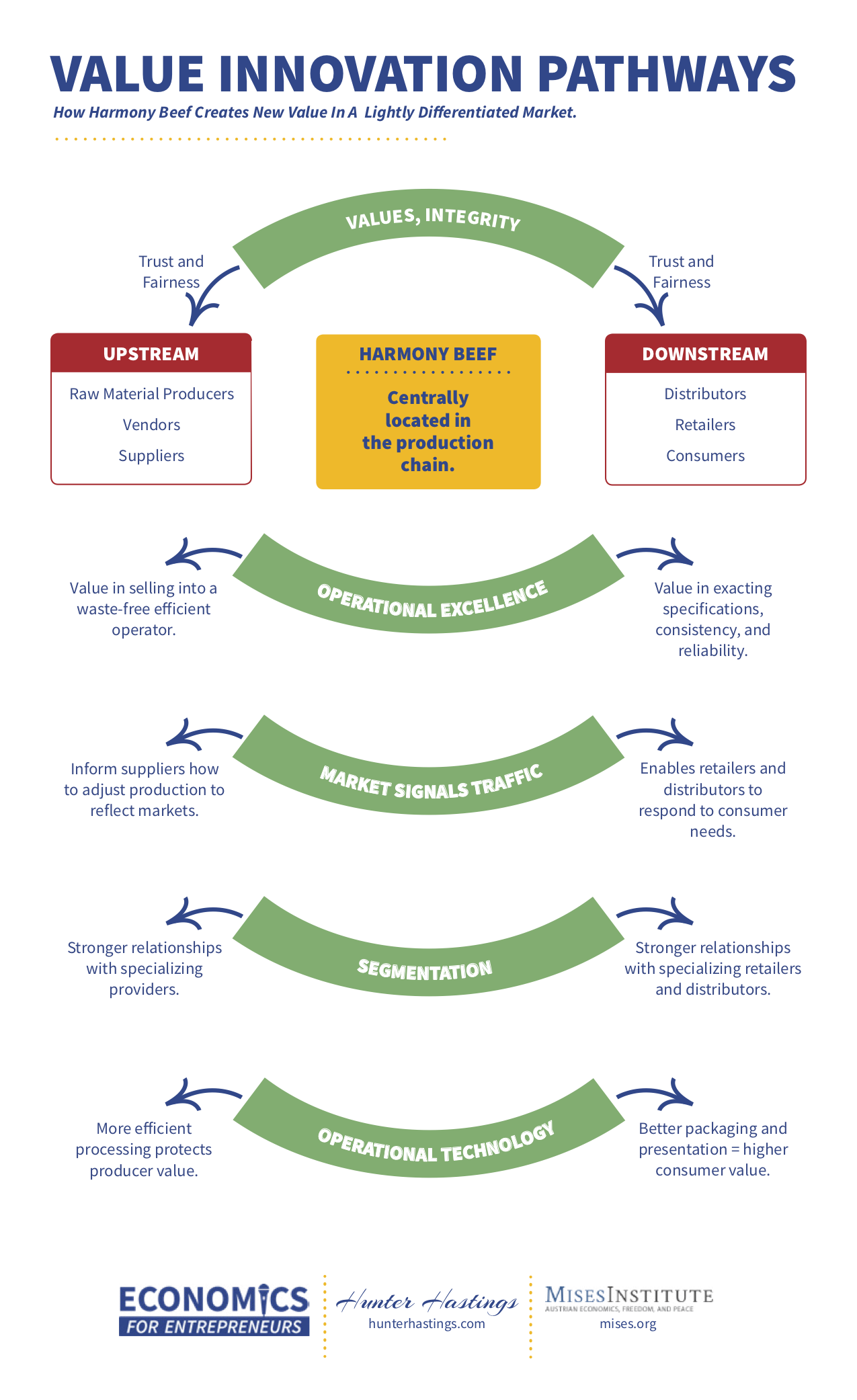

Customers are always evaluating, and thereby producing value. They do this from the context of their own system. Let’s take an example of a consumer household and its systems (although we must emphasize that the value entrepreneurship model applies equally to the world of B2B, not just B2C). Let’s take one sub-system: food and nutrition for the family. There’s a system of deciding what to eat and drink, there’s a system of shopping, whether online or offline or both, there’s a system of storage, perhaps involving freezing, refrigeration, and room temperature. There’s a system of preparation and cooking, involving a lot of home appliances. There’s a system of cutlery and place settings, and another for washing these. Taken altogether, it’s a complex system. And it may be continuously changing. What if the family Is becoming more conscious about healthy eating? What if they start substituting lower-calorie foods for higher-calorie versions? What if they start reading ingredient labels? What if they buy more fresh food and less manufactured food? What if they discover new preparations like blenders?

We can see the physical manifestations of these changing experiences in the market. The periphery of the supermarket where the fresh foods are sold becomes bigger and the center contracts. Healthy cookbooks appear on amazon and social media. Fresh fruit appears in more convenient packaging and new varieties flourish. New brands of healthier crackers and desserts abound.

The point about value is that it is formed in the customer’s system, that system is complex, and it’s always changing. The role of the value entrepreneur is to observe the system, understand the system, fit into this system and make a contribution. It’s possible to identify gaps, maybe gaps the customer is not even aware of. Most importantly, there’s the potential to identify the system the customer will prefer and move to in the future, ideally before they get there themselves. This is value innovation – imagining and inventing the future. Whether in the present or the future, the entrepreneur’s contribution is to help the customer to feel satisfied that they’re making the best choices within their own system. Their system is life, and entrepreneurs help make the system work for them.

Entrepreneurs and entrepreneurial businesses facilitate this feeling of value – make it possible, make it robust, make it repeatable. They are rewarded by customer purchases, and value flows back to the firm as cash flow, to be reinvested in more production and more innovation. The value entrepreneurship loop is continuous.