123. Sergio Alberich on Capital Structure and Capital Flexibility

The proper selection of a firm’s financial source does not guarantee its success, but the wrong one assures its failure.

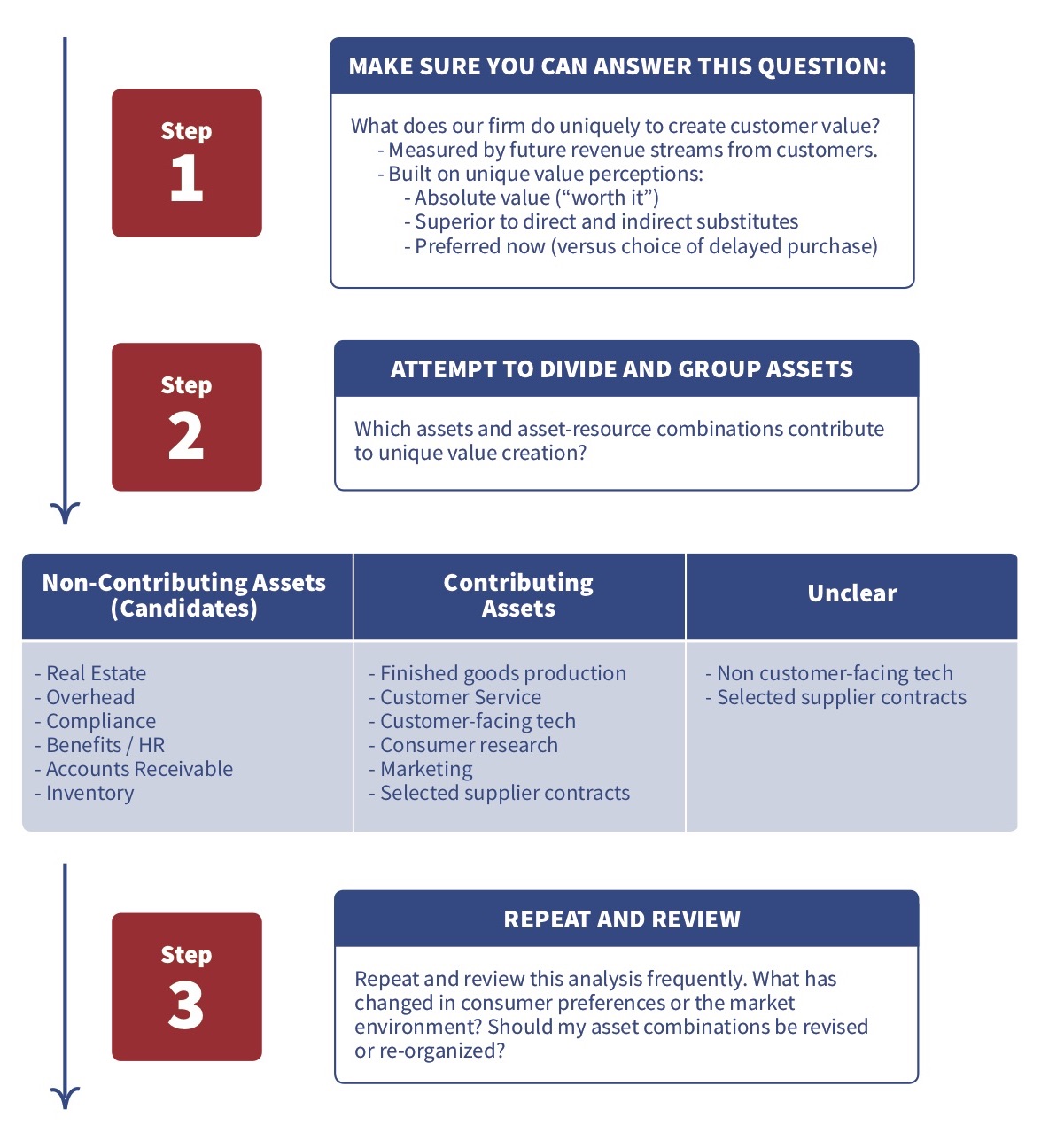

Austrian capital theory delivers actionable insights for business. Austrian theory emphasizes capital’s economic role in generating customer revenue flows. Since these flows are variable, entrepreneurial capital must exhibit a capacity for agile and flexible combination and re-combination to keep revenue flows refreshed and current, Since capital structure plays an important role in entrepreneurial judgment, decisions, and action, it must support fast, flexible and unconstrained decision making. Businesses can benefit from their understanding of capital through this Austrian lens. Sergio Alberich helps the Economics For Business podcast listeners, and business practitioners in all kinds of businesses at all stages for their development, to Think Austrian in matters of capital structure.

Key Takeaways & Actionable Insights

Entrepreneurs designing a firm’s capital structure should view their choices through the twin lenses of ownership and control.

Ownership and control are tradeable assets for the entrepreneurial firm. In order to obtain capital financing, one or the other or both might be offered up by the entrepreneur or requested by the financier.

How will shared ownership play out now and in the future? Will ownership imply only a share in any future returns? How great a share is the entrepreneur willing to trade? What will it feel like to receive only a portion of the return the entrepreneur worked for? How much more ownership will be given up in future financing rounds?

Can ownership be traded without any loss of control over decision-making and future investments? Alternatively, how much control should be traded? A board seat? An investment committee? The financier wants the entrepreneur to be free to make the decisions for which he or she is best-informed and most capable, and yet wants to be protected from managerial error.

There are many factors that can stand in the way of capital flexibility, and organizational issues of ownership and control become paramount.

Debt and equity are the basic choices as building blocks of capital structure.

Debt and equity are basically different kinds of contracts between the individuals managing / operating a project and those funding it. Debt is a fixed claim with a known annual return to the debt holder. Typically, the debt holder has no control over management decisions and is not involved in managing the company (although there are some covenants that can be written to provide some distant control).

The return on equity for the financial investor is residual, after debt repayments are made, leaving entrepreneurs relatively free to allocate costs and direct operations. But equity holders typically hold voting rights, and can therefore exercise some control in some circumstances. They may also exert strong influence on management decisions based on relationships. For example, family and friends investors may exert special relationship influence.

There are some debt-equity hybrids — most notably convertible notes, debt that is convertible into equity at some future stage or event. The negotiation of this instrument brings more complexity to the ownership-control debate, while giving the entrepreneur leeway to consider issues of valuation in the future rather than at the current financing.

Entrepreneurs must also consider human factors, especially the number of people in the capital structure.

Another major consideration for entrepreneurs is whether to raise debt or equity from a few people or many (e.g., via IPO or a bond that hedge fund investors can buy). Raising capital from large numbers of investors creates categorically different situations for the entrepreneur. An IPO, for example, can not be a highly tailored instrument. Institutional conventions and regulatory rules impose many requirements about how entrepreneurs and their managers communicate, how they frame financial risk, and about the nature of widespread shareholder engagement they take on. Just think of the interaction of Elon Musk on Twitter, with the SEC, and with short sellers.

In general, the fewer the number of investors, the greater the operating flexibility for the entrepreneur. There are fewer people to convince when business seeks to make a major change, or to pivot.

Sergio Alberich outlined 4 levels of consideration for the financial investor providing capital to the entrepreneurial firm.

Level 1: How are the factors of production combined in the firm, and how might the combination change in the future? Elements of this level of consideration include the stage of business in its growth journey and the assessed maturity of its business model, industry, and competitive set; the nature of the business’s relationship with partners, suppliers, channels and customers; and the state of knowledge regarding product, service and market development.

Level 2: What is the nature and scale of cash flows now and in the future? Are there mature, reliable cash flows? Is one part of the business a drain on cash resources? Is cash coming in from investments for operating expenses (which are not really flexible).

Layer 3: What are the possibilities for returns? Both entrepreneurs and investors seek profit – not just accounting profit on the P&L but returns on equity. At an early stage, a company may worry about generating future cash flows and less about the cost of equity (in terms of sacrificed future returns) to finance growth. A more mature company with cash flows in the present pays much more attention to the cost of equity, and to cost of capital in general, seeking to preserve as much return as possible.

It is often the case that entrepreneurs give up too much equity in order to secure early stage venture capital funding, whether directly of via convertible loans. To keep the entrepreneur motivated with equity that promises future returns, it is best for them to deal with just a few investors who understand this motivation.

Organizational design is relevant, too. For example, a law firm with 100 partners, each of whom own 1 share, and limit their business model collaboration to sharing real estate costs and IT expenses, while effectively running 100 projects, might be creating a politicized nest of vipers. A partnership with shared equity in one business, where everyone stands to lose a lot if there is a bad decision, is likely to be much more collaborative, conducting a unified business, rather than acting as a co-operative of individuals sharing costs.

In the end, subjectivism in entrepreneurship prevails.

As we emphasized in episode #108 (see Mises.org/E4B_108), businesses perform best when entrepreneurs are free to make subjective decisions. The proper source of capital is one that most enables this subjective freedom, which may not be the optimum source based on spreadsheet calculations. Subjectivity and entrepreneurial judgement are not math. The best economic role of capital finance lies in helping entrepreneurs make better human subjective decisions. This is the essence of the means-ends calculation for both entrepreneurs and investors. Austrian economics gives by far the best guidance on this economic role of capital.

Additional Resources

“Austrian Capital Financing” (PDF): Download PDF

“Austrian School vs. Neoclassical School” (PDF): Download PDF