54. Steve Mariotti: Teaching Entrepreneurship as the Universal Route to a Better Life.

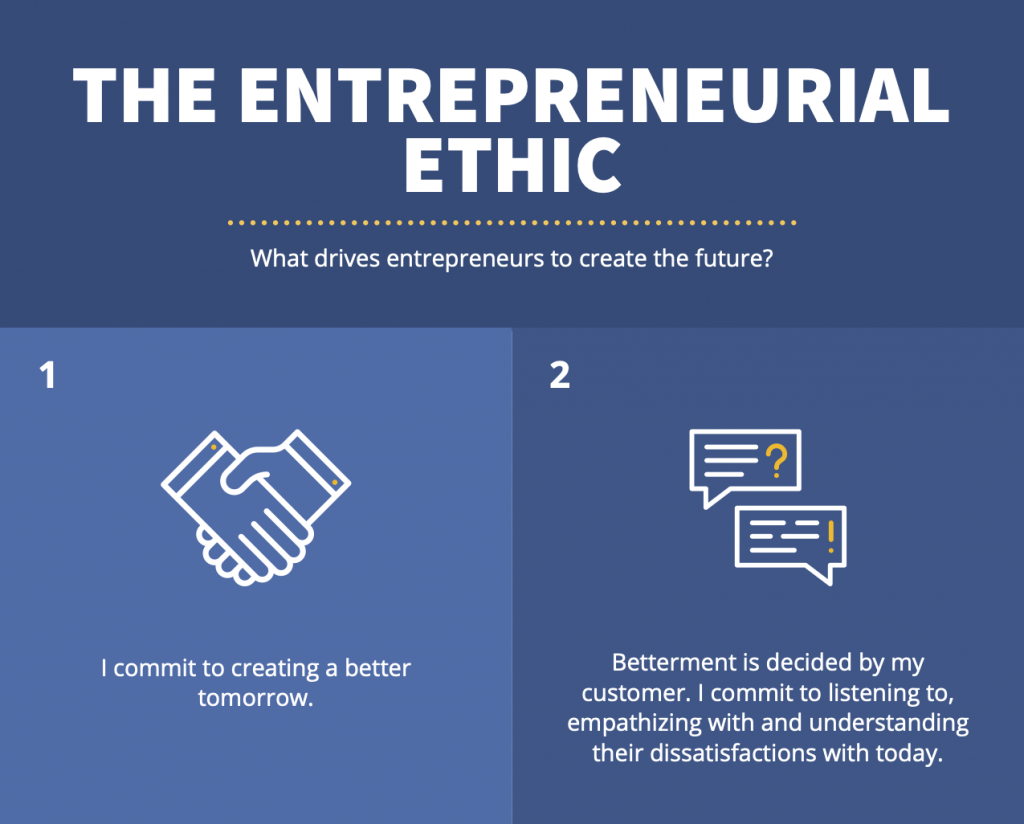

Can entrepreneurship be learned? We’d like to believe it can, since entrepreneurs drive economic growth – creating tomorrow as Per Bylund puts it – and betterment for their individual customers and for society.

Key Takeaways and Actionable Insights

Emergent circumstances placed Steve Mariotti in the position of teaching entrepreneurship to boys and girls in the nation’s toughest high school. After some trial and error, here’s what he established.

There’s a universal desire for the fruits of entrepreneurship. Steve classified this desire as a drive to escape poverty.

You are restricted from ownership, and all the feelings of pride and fulfillment that come with it, when you are poor. Ownership – what economists call private property – is an exciting prospect. If entrepreneurship provides a route, people will take it.

Steve’s innovative entrepreneurship curriculum generated intense excitement.

He had difficulty in commanding attention for English and Math, but the same students who resisted conventional learning were stimulated and energized by the subject of entrepreneurship.

The open door to learning entrepreneurship is understanding market pricing.

Steve started the entrepreneurial journey for students with thinking about pricing of an everyday product – in his case, wristwatches. Why are there so many prices for wristwatches? Why are there so many kinds of wristwatches at different price points? Why is it that one person would pay a high price for one kind of wristwatch and another person would refuse, preferring an alternative at a different price? Just thinking about pricing in this way was a revelation.

Thinking about pricing can lead to an understanding of unit economics.

Entrepreneurs need to know two prices – the one the buyer will pay and the one that represents their cost. Steve quickly established that this knowledge is harder to establish. Is there a profit in the priced transaction for the entrepreneur once all costs – of time, money, effort and alternatives – are taken into account. This requires an understanding of sourcing and supply chains, wholesalers and vendors, direct and indirect costs and overhead, as well as personal preferences (do you really want to spend all the time and effort that the business will require of you?)

High schools are resistant to teaching entrepreneurship, and Steve’s students were constrained by regulation and authority.

“You may not talk about money in the classroom.” These and other restrictions were typical of the barriers Steve faced – and faced down. Entrepreneurship is one of the most relevant skills to impart to high schoolers, and yet the subject was viewed with disdain.

Steve emphasizes practicality as the critical foundation for teaching entrepreneurship.

He taught his kids unit economics, profit and loss, simple accounting and the practicalities of starting, growing and managing a business. No theory. Everyone in his class succeeded with a starter business. Many went on to greater entrepreneurial success.

Steve has taught entrepreneurship all over the world, and found that culture matters a great deal.

In post-communist Russia, young people could not grasp supply and demand, entrepreneurial profit and unit economics. The labor theory of value had been brainwashed into them.

In post-communist Vietnam, in contrast, people thronged to his teaching and eagerly pursued all the behavioral changes he advocated, both at the entrepreneurial level and the government administrative level (like adopting low, simple tax schemes). Theirs was a more receptive culture.

Items Mentioned In This Episode

Steve’s Book Goodbye Homeboy – Click Here

Steve’s Book Entrepreneurship: Starting and Operating A Small Business – Click Here

Austrian Entrepreneur’s Journey Course – Click Here

Free Downloads & Extras

The Role of Knowledge In Entrepreneurship: Our Free E4E Knowledge Graphic

Understanding The Mind of The Customer: Our Free E-Book

Start Your Own Entrepreneurial Journey

Ready to put Austrian Economics knowledge from the podcast to work for your business? Start your own entrepreneurial journey.