32. James Beardsley: Seeing the Business World More Clearly

James Beardsley owns and runs a law practice. He decided from the outset that he would run it like a business — not all lawyers do — and, once he had discovered Austrian Economics, he saw more clearly how to succeed in reaching his goal.

Hunter Hastings and James discuss the principles of Austrian Economics that James puts to work.

Key Takeaways and Actionable Insights

Self-assessment: The entrepreneur is an individual with a role to play in society — someone who breaks new economic ground as a business owner, leader, team member, or contributor. That’s why we say that the entrepreneurial journey starts with self-assessment. James Beardsley’s was that he wanted to be a different kind of lawyer — one who ran a business rather than just a professional practice. That’s a commitment to approach, method and lifelong learning — a commitment he has maintained for many years.

Find applicable models: James sought models and principles for successful businesses of all kinds. Entrepreneurs break new ground, but before they do, there is no reason to ignore the empirical and historical data that can provide a foundation on which to build a new approach.

Read the books that can help you establish core principles: James was reading business and investment texts, and discovered Austrian Economics, which he felt covered the same topics with better logic and greater clarity. Austrian logic — breaking issues and challenges down to their simplest and most basic levels, establishing understanding at that level, and then building up from there — helped him immensely. He did not become an expert on economics, but identified and applied the core principles.

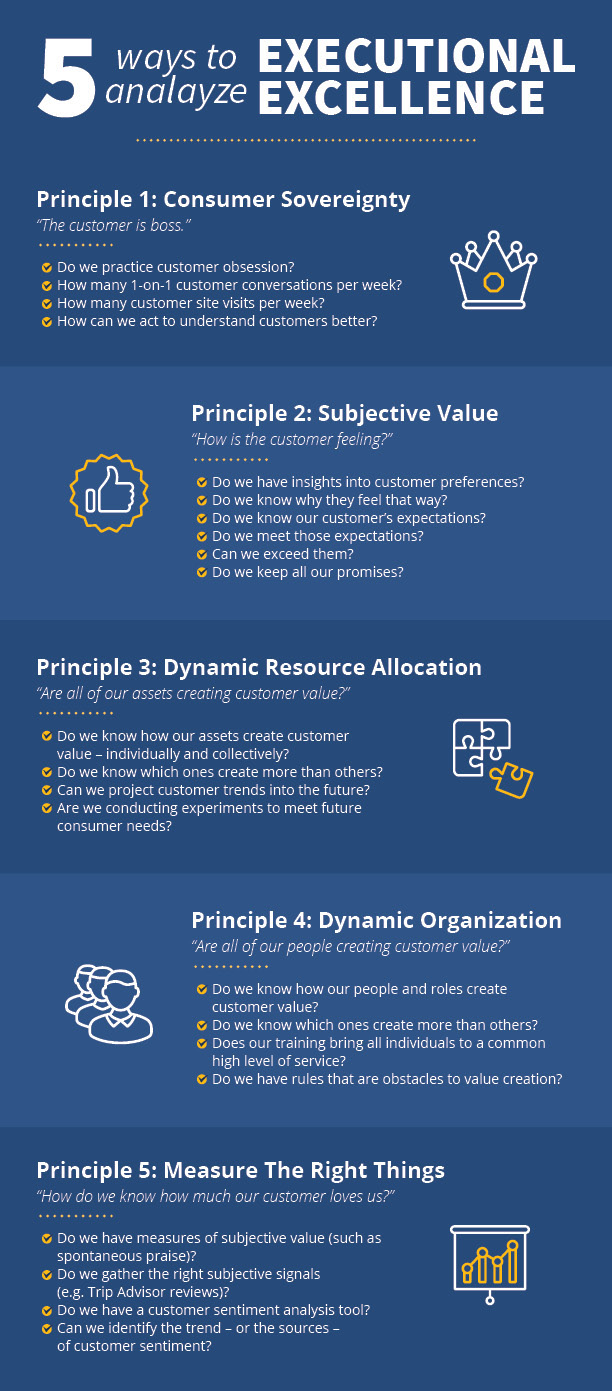

Identify the customer and their problem-to-solve with precision: James’s chosen target customer is very precise: people who experienced injury in a car accident. This precision yields certainty in the process of developing services for the customer.

Think from the perspective of the customer: Having identified the customer, think like they think. Accident victims are jarred; their lives have been changed dramatically; they are experiencing emotional turmoil; they don’t know how the legal process works; they may be angry or scared. Trying to think the way they think, and accepting their need, can lead to providing the compassionate help they are seeking.

Know their personal value scales: Every individual has their own value scale, and what is most important to one customer is not the same as what is most important to another. James’s firm seeks to understand each individual client’s personal value scale and to respond appropriately.

The customer creates value: At E4E, we try to stress that value is subjective and therefore created by the customer; the entrepreneur is a facilitator. James’s process is a striking example: accept the customer’s perspective, identify and adjust to their personal value scale, and let them determine the kind of service they prefer.

Empathy is the most important entrepreneurial skill: Throughout our conversation, James stressed the central role of empathy as the skill that he and his team employ to enable them to think from the customer’s perspective, identify their values, and to provide them with the reassurance they need in a difficult period in their life. The empathic process builds trust and long-term relationships.

Empathic diagnosis is the specific application of empathy: James stresses listening, trying to understand how the customer is feeling, understanding that perhaps they do not know how to react and therefore may not be able to communicate clearly, or may do so through a veil of denial or anger or frustration.

Hire people with the right disposition for the empathic process: Assembling the best set of entrepreneurial resources includes hiring the right people. Some people — but not all — can be trained to serve the customer with empathy. Provide them with a process and system to guide them, but recognize that not everyone will prove themselves at the task, and make a change as soon as the need for one is indicated. It’s critical for the health of your business.

Marketing is a fundamental tool for business success: Many entrepreneurs don’t leave enough resources for marketing, and this can be an error. James takes the Austrian causal-realist approach, which is the professors’ term for the base logic of Austrian Economics. “Realist” means seeing the world as it really is, rather than how you would like it to be. Law firms need clients and they are not just going to walk through the door. James’s target customers are unaware of the availability of the services that can help them. Therefore advertising is required. “Causal” means understanding what works to solve the problem at hand. In this case, James built up a database of “what works and what doesn’t” to bring clients to the firm, and advertising — specifically TV advertising — proved to be the right tool, as measured by revenue realized minus costs expended.

Understand and employ the concept of opportunity cost: Resource allocation and spending decisions are always trade-offs and the best tool to make them definitively is to apply the concept of opportunity cost. If I allocate resource X (e.g. an advertising budget), what is the next best resource I am choosing not to allocate (e.g. hiring an additional staff member)? Is that the best use of resources? Which one will serve the client best? Which one will deliver most revenue for the firm? The point is to do the analysis carefully and honestly, so that you can be confident in the decision.

Understand the value (and cost) of time: Austrian Economics focuses quite specifically on the time it takes to produce, and the cost to the entrepreneur of this production timeline. Costs are incurred while no revenue comes in. James methodically addressed this cash flow challenge, and has become adept at identifying cases that can be expected to settle faster, and he will select for that attribute even if the end-revenue is smaller. “The prospect of getting paid two years out is less risky than getting paid four years out.”

Take active steps to manage and reduce uncertainty: We always highlight the role of uncertainty about the future as an important component of entrepreneurial action. James has found ways to narrow uncertainty. One example is to take only cases where the responsibility is clear, and so the uncertainty is limited to the settlement. That is less uncertain than being unsure whether you will win or lose the case. Another uncertainty-narrowing action is to keep a sufficient cash reserve so that fluctuations in cash flow will not impair ongoing business processes. This makes possible the avoidance of debt obligations, which are always troublesome for a professional services business.

DOWNLOAD

Download Our Austrian Economics – A New Lens PDF (129 KB)