The Culture Of Entrepreneurship Promises An Exciting Breakout From Government, Corporatism And Dependency.

The science of economics has a big problem with vocabulary. It attempts to capture complex concepts in single words and phrases, which only serve to confuse and befuddle and cause arguments. To take a current example, the word “socialism”, for an economist, means state ownership of the means of production (which, in itself, is a good example of clunkiness in economic terminology). But when the country and its journalists and its bloggers argue about socialism and who is or is not a socialist, they’re not arguing about who owns the means of production. They’re arguing about forcible redistribution of people’s income by government, and about the top-down imposition of all-encompassing resource allocation schemes like Green New Deal and Government Health Care. They’re arguing about the role and scope of government and what it means to be free. “Ownership of the means of production” doesn’t help us understand the issues to any great extent.

The opposite of socialism is entrepreneurship. This is another word that comes from economics, and is even harder to define than socialism. The definition of entrepreneurship at the Library Of Economics And Liberty (econlib.org) is 2000 words long. Within those 2000 words, there are references to the many disagreements between economists as to what entrepreneurship really means.

Let’s propose that, instead of defining entrepreneurship, we examine it as a complex and multi-faceted system of individual and social human behavior, and identify its consequences.

Entrepreneurship is the system for the generation of betterment for all in a society characterized wholly or partially by both collaboration and private property.

Entrepreneurship is action. Entrepreneurial individuals, teams or groups are alert to situations where their fellow citizens are dissatisfied with current conditions – when they feel things could be better. Entrepreneurs see this as an economic opportunity: if they take action to devise a new, different and better offering than is currently available, people might buy it to improve their condition, delivering a profit to the entrepreneur. Entrepreneurs do take that action – that’s what separates them from others. There’s a risk in acting. It takes time to design and produce the new offering; the finished product or service may not be as good as the entrepreneur imagined in the design phase; the selling price may not be right; the consumer may have changed preferences over time and no longer wants this new solution, instead preferring someone else’s offering. But whatever the outcome for the individual entrepreneur, the system is a win-win. The consumer ultimately has the choice of the various new offerings, and at least one entrepreneur is rewarded, and society is better off. The entrepreneurs who were not chosen by the consumer in this case will redirect their efforts in another direction until they find the right exchange in which they can reap the reward of the marketplace.

The nature of the entrepreneurial system is that both consumers and producers experience reward when one responds to the other in a way that aligns what the consumer wants with what the entrepreneur can provide. It’s a collaborative win-win, and society (i.e. all the producers and consumers rolled up) progresses and improves. Consumers are more satisfied. Entrepreneurs are more fulfilled. GDP per capita rises. The world gets better.

The system works for everyone.

The econlib.org encyclopedia entry on entrepreneurship informs us that widely cited studies conclude that between one third and one-half of the differences in economic growth rates across countries, states and localities can be explained by differing rates of entrepreneurial activity. Economic growth is the economists’ way of saying “things get better for everybody”.

That’s because the goal of entrepreneurs is to help customers towards better lives, in which they experience feelings of greater satisfaction. When they succeed, the entrepreneurs get paid, i.e. achieve the monetary reward of profit. And they, too, also feel greater satisfaction: a sense of achievement and the expanded horizons that come with success. Entrepreneurs’ personal pursuit of higher aspirations results in consumers’ attainment of higher levels of satisfaction and happiness. Everybody wins.

Entrepreneurship blossoms in a culture that supports it and admires it.

Entrepreneurship requires an institutional and cultural framework in which it can blossom. Primarily, it thrives in political and economic systems that protect and secure private property rights. The entrepreneur must have control over private property in order to transform it into new offerings and solutions for consumers to choose and enjoy. In this case, private property includes their own personal effort and ideas, physical resources and capital, and money to invest.

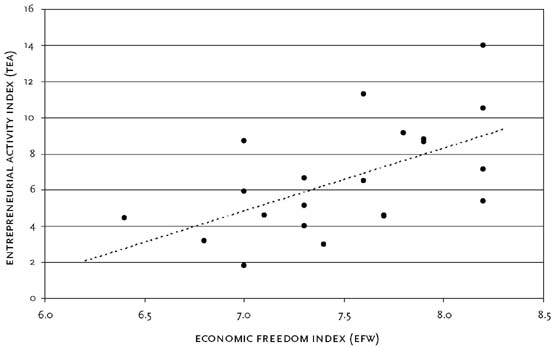

More broadly, entrepreneurship thrives in a framework of economic freedom: low taxes, minimal regulation constraining entrepreneurial imagination, and an unbiased and rapidly-functioning judicial system to resolve any contract disputes that arise. Empirically, the level of entrepreneurial activity in a country correlates closely with the Economic Freedom Index, a measure of the existence of premarket institutions.

There’s also an important element of how we think about feel about and talk about entrepreneurs and business’s role in our culture. If the culture tags the successful entrepreneur as an exploiter rather than a hero, and emphasizes the inequity of outcomes – some succeed, some don’t – rather than the achievement of those who establish and grow successful firms, then society will turn against those who bring betterment. We must, as Professor Deirdre McCloskey insists, assign dignity to our entrepreneurs.

The main barriers to entrepreneurial productivity are governments and corporatism.

Government action – regulations, subsidies, tariffs, taxes, manipulation of labor markets and financial markets, and so much more – impedes entrepreneurship. Governments limit the scope of entrepreneurial imagination and freedom, by restricting what is possible. They divert the productive efforts of entrepreneurs through taxation, which is the confiscation of the fruits of productivity so that they can be put to unproductive uses. They restrict productivity via regulatory constraints, such as the limitations on the location of new production facilities (think solar energy farms) and the distribution of produced goods (think interstate electricity distribution). Government, by its very nature, is anti-entrepreneurial.

As government gets bigger and more interventionist, it brings into existence new barriers to entrepreneurship. Entrepreneurial action can take place at any organizational scale – single employee companies, small businesses and venture-funded startups, and within medium and large-sized businesses. But, as Michael Munger explains, government distorts the incentives for entrepreneurship by creating conditions in which a dollar invested in lobbying can provide a greater return than a dollar invested in R&D and innovation. If a large corporation can secure the passage of a bill or a regulation or a tax or a tariff that is favorable to its business and unfavorable to competitors, domestic or foreign, it will be tempted to make that investment. R&D is starved, innovation is slowed or stopped, and incumbent corporations are insulated from the creative destruction that entrepreneurs generate and which raises consumer satisfaction through innovative improvement.

If we can restrict government and reduce its level of regulatory and fiscal activity, we will enjoy a double boost in economic productivity because the temptation for corporations to spend money cozying up to regulators and legislators will be reduced, if not removed, and the level of investment in entrepreneurial innovation will be increased.

Entrepreneurship is the antidote to the culture of dependency.

At the level of individual behavior and attitude, the culture of entrepreneurship can be energizing, motivating and fulfilling in ways that the current culture industry of state schools, leftist media and welfare state socialism can never emulate. The entire cultural edifice of government and its associated institutions is dependency. This culture insists that individuals can not be successful without state assistance, welfare, subsidies, and regulatory control. Since our children are continuously and exclusively indoctrinated in this dependency framework from the earliest age in state schools, it is not surprising that most of them never get to experience the joys and rewards of entrepreneurial striving. They feel that they must depend on others, especially the welfare bureaucrats, to achieve whatever goals they are capable of conceiving. As a result, self-reliance, imagination, resourcefulness and entrepreneurial energy are under-developed attributes among our young population. The long-term drift towards suffocating hopelessness and helplessness sometimes feels irreversible.

Yet the spirit of entrepreneurship has not been fully extinguished. We still have some entrepreneurial heroes, despite the cultural repudiation of “millionaires and billionaires”. We still have some supportive branches of our institutional framework, including local small business groups, entrepreneurial business school courses, private online education, incubators, venture capital, private loan platforms, and exchange platforms like Upwork and Angie’s List. Perhaps someday, we’ll be able to extend that list to include pro-entrepreneurship public policy.

Until that day, let’s celebrate every entrepreneur who breaks out from statism, corporatism and dependency.