In Aberrant Capitalism, Steve Denning and I ask why perceptions of and opinions about capitalism have eroded to the point that some young people are willing to say they would choose socialism in its place. That’s irrational based on the objective outcomes: capitalism is the economic system associated with the greatest growth in well-being in all of history.

Upon further examination, it turns out that the criticisms directed at capitalism are provoked mainly by one of the system’s forms of implementation and not by the system itself. Corporations are the entities that pay wages and salaries (therefore creating income equalities), create shareholder wealth inequality (since they are the ones issuing shares and driving up their trading value), and cause environmental degradation. Corporations are viewed as cold, calculating, exploitative, and indifferent to social issues.

Aberrant Capitalism examines the roughly 160-year era of the capitalist corporation and maps the entropic decline from a golden age of celebration to an age of disdain. Corporations were a timely, enabling innovation for capitalism in the second half of the nineteenth century, making possible the achievement of scale and scope that brought illumination, transportation, communication, mechanization, health, and nutrition to customers in America’s, and then the world’s, homes and factories. These were the corporations of entrepreneur owners, unentangled with government or a financial sector, focused on customer benefit. The golden age of corporations was an age of customer capitalism.

But when the entrepreneurs exited and managers entered, systemic erosion began. Not immediately—the first generation of managerial capitalism exhibited several examples of further advances in customer capitalism. But managers pursue different goals than entrepreneurs, including control, consistency, and efficiency. They seek to erase entrepreneurial uncertainty, preferring predictable outcomes to creativity. Command-and-control management systems began to emerge, bringing bureaucracy with them.

Two war economies – World War I and World War II – and the New Deal significantly accelerated the shift to central planning as a form of management both in government and private industry and also served to entangle those two together. After World War II, executives who had been called into government to run War Boards and planning agencies, with all their pervasive controls over production, prices, and resource allocation, moved back into industry. They reproduced the centralized government bureaucracy in the strategic planning arms and bureaucratic structures of companies like GE and IBM.

Later in the twentieth century came the expansion of the financial sector and the change in purpose of the corporation from generating subjective value – a feeling of well-being and satisfaction – for customers to maximizing value for shareholders (MSV) – a mathematical calculation for a very narrow group of investors, and for the managers themselves who awarded themselves stock and stock options so that MSV served them as well. It was not unusual for corporations to utilize more than 100% of their net earnings as stock buybacks and dividends rather than invest in R&D for future customer benefit.

The major protagonists of the capitalist system have become internally-focused, bureaucratized central planning organizations, with rigid structures, entangled with government, and beholden to investors and stock markets more than customers. Many people despair of them, and hope for something better.

There is some prospect for hope in the digital age. It is the nature of the new digital firms that change is initiated from the bottom up and the outside in because customers have direct access through the new business models of the era, and their preferences can be transmitted to the corporation more effectively. But the new corporations are paradoxes – more customer-centered than before, more responsive and agile, but still bureaucratic, still government entangled, and more able to exert control through their business model’s data collection and machine learning components. The promise of the digital era is to lead us out of a period of aberrant capitalism – but the forces of centralization, bureaucracy, government entanglement, and financialization have not been defeated.

Aberrant Capitalism proposes a new integration of entrepreneurship and management – “entrepreneurial management” – as the potential resolution.

- Introduction: Corporations are the primary protagonists of capitalism

The real target of critics of capitalism is corporations, not capitalism itself. Corporations were an emergent phenomenon of the capitalist economy from the second half of the nineteenth century – there was capitalism before the corporation. Corporations grew and evolved in ways that were favorable to the well-being of customers while at the same time self-serving and value-extracting on behalf of management and shareholders. This duality is beginning to tip in favor of the corporation at the expense of the customer and society.

- Capitalism Before Corporations

There was plenty of capitalism – commercial business activity to create new value by serving customer needs profitably – before corporations came along. Richard Cantillon and Adam Smith both wrote about it. As an empirical example, Aberrant Capitalism highlights Wedgwood and Bentley, a partnership (the most prevalent form of organization in the pre-corporation era) operating in the pottery industry. Wedgwood and Bentley exhibited the customer-oriented mindset of capitalism by continuously innovating to improve both the functionality and appearance of tableware while at the same time lowering prices to broaden accessibility to more and more working families. At the same time, the firm recognized new opportunities for market segmentation, with a different product line at various price points for aristocracy and royalty. Wedgwood and Bentley innovated in the application of technology, new production systems, new ways of organizing, and new marketing techniques, including retail display marketing, sampling, and free shipping / free returns.

But Wedgwood and Bentley never became a big business. The partnership could not realize the scale and scope of the corporations of the future.

- Entrepreneurial Ownership and the Golden Age of Corporations

The new form of corporate capitalism emerged in the second half of the nineteenth century. New legal institutions shaped the corporate form, while at the same time, the entrepreneur owners of the corporations learned that service to the customer and value for the customer were the drivers of their success. People were engaged in creating a new context and new modes for living: not just a market of unprecedented scale, but new geographical reach, new connectivity via railroads and telegraph, new technologies to utilize, new ways to collaborate and exchange, new shared experiences and new shared realities, a new dynamism and a new mentality about what was possible.

The corporate form was essential to aggregating the unprecedented amounts of capital and operating funds required for large-scale railroads, factories, mills, refineries, and pipelines. Corporations were an organizational innovation that addressed customers’ needs for transportation, banking and insurance, energy, water, food, and clothing as they expanded cities and ventured into new territories. Corporations competed in the industries of the future.

Quaker Oats, Sears Roebuck, Procter and Gamble, and Standard Oil are a few of the numerous corporations highlighted as examples of customer capitalism. Standard Oil? Yes. Historian Paul Johnson wrote that “no other has done so much for the ordinary consumer” and picked out John D. Rockefeller as one of the “prospering fathers” – entrepreneurial individualists who transformed the nation and the world – and not a “robber baron”; after all, whom did he rob?

Notably, the rapid growth of the large corporations was funded primarily via cash flow and retained earnings, and the financial sector held no great sway. The corporations were entrepreneurially creative, dynamically efficient, self-funding innovators and price reducers, unentangled with government. It was a golden age.

- The Early Twentieth Century– One Step Forward, Two Steps Back

In the first part of the twentieth century, the management organizations that had inherited control of corporations from their entrepreneurial founders and leaders made further advances in customer capitalism via multiple innovation streams. Aberrant Capitalism highlights Siemens organizational innovations in Germany, GM’s multi-divisional market segmentation, and P&G’s invention of the brand management system, where each brand manager was an entrepreneur, and the purpose of each brand was to understand and serve customers.

But there were two major developments that dramatically changed capitalism and pushed corporations in a new direction. The regulation economy of the New Deal and the command economy of World War II changed the attitude of both businessmen and consumers toward capitalism. Capitalism was not the same afterwards.

Politicians declared that the economic downturn of what we now call the Great Depression constituted an emergency of the same character and same dimension as war and claimed emergency powers to intervene. In a barrage of legislation, regulation, and presidential proclamations, government battered down the normal barriers separating business corporations from political control. Politicians even changed the descriptive language of capitalism. “Competition” became “economic cannibalism,” and “rugged individualists” became “industrial pirates.”

The coming of the Second World War exacerbated the already centralizing tendencies of the New Deal, with more central planning and control in the government-led establishment of a war economy. Aberrant Capitalism details these controls. As economist Joseph Schumpeter said in 1949, “We have traveled far indeed from the principles of laissez-faire capitalism.”

- Post-War Capitalism: The Age of Control

Historian Jonathan Levy identifies the “dramatic post-1945 hinge” as the most important moment in the history of American capitalism. Capital, in the form of industrial manufacturing, was productive but illiquid and inflexible, and profits were reinvested mostly in existing business lines. Corporate management became an educated and trained bureaucracy. Aberrant Capitalism employs data from General Electric Company (GE), from the post-WW2 period to the 1980s, to represent corporate managerialism and its vast internal central planning machinery. It produced an opacity so dense that the CEO, Reg Jones, admitted that “we could not achieve the necessary in-depth understanding of (our own) 40-odd SBU plans.”

Nevertheless, GE’s implementation of control capitalism gained the company the status of “most admired” (Fortune magazine) and “most respected” (Financial Times). The big businesses of the era adopted the control-oriented model, albeit occasionally executed in different ways.

One consequence of the heavy weight of management was what Nobel prize-winning economist Oliver Williamson called managerial slack: a preference for adding costs that did not increase customer value. Slack included high salaries and benefits for management, large office spaces, unnecessary staff, inflated advertising budgets, and even R&D and M&A activities designed to enhance personal power more than business performance. Organizational slack hardens into a permanent increase in the corporation’s cost base via the annual planning and budgeting process, subordinating customer objectives to managerial objectives.

- The Age of Financialization

In the later years of the twentieth century, the expansion of the financial sector and the frenzied decoupling of financial capital from production capital has resulted in the financialization of the corporation. This includes the elevation of the stock market and other financial market institutions and components to a position of strong influence over the allocation of resources that causes a shift away from long-term reinforcement of productive and innovative enterprise and toward short-term financial performance goals, undermining the innovative capability of the industry.

Financialization is a fundamental undermining of the purpose of the corporation. The corporations that had shown a pattern of investing in organizational learning and strengthening their capacity to innovate since the nineteenth century turned to speculative manipulation of their stock prices on stock exchanges. Aberrant Capitalism examines stock buybacks as an example of this self-dealing, and GE 1980-2001 as an example of the distortions exhibited by the financialized corporation.

- Institutionalized Control

Institutions are the formal and semi-formal rules and conventions regarding business conduct and guiding business behaviors. Today’s institutions provide a framework for shifting the focus from customer value creation to shareholder and investor value capture.

Financial institutions: The institutional role of stock markets has transformed from the support of entrepreneurship to an emphasis on cash distributions to share traders and top management through buybacks and dividends, which contradicts the original concept of capitalism. Venture capital is an institutionalized dash to stock appreciation. The stock ownership cartels of Blackrock, Vanguard, State Street and others like Berkshire Hathaway support the idea that the corporate purpose is the accumulation of appreciating stock and dividend flows.

Management institutions: Business schools and business publishing, the institutions for propagating, standardizing, and communicating business philosophy, business practices, and business methods, have enthusiastically embraced the primacy of the financial sector, the financialization of corporate purpose, and the shareholder value maximization thesis. The entire concept of business strategy, as taught in many business schools and propounded by some consultancies and authors, is flawed by its outcome bias toward maximizing shareholder value.

Bureaucracy is institutionalized slack that wastes time, breeds inertia, shelters corporations from customer feedback, and hoards power and control. Capitalism is carried out within large organizations in which the upper echelons of bureaucracies in the productive and financial sectors are effectively fused in the pursuit of new ways to monitor, control, manage, and surveil rather than pursue value creation for customers.

Political institutions and the entanglement of business and government: Antitrust laws, financial regulations, ESG, DEI, and taxation manipulation can all lead to the diversion of value from customers, and the revolving door from the top of government agencies to the top of management organizations exacerbates the problem. We highlight SEC Rule 10b-18 as a particularly consequential example.

Prevailing economics: Entrepreneurial value creation is not recognized as a system driver in mainstream economics. The emphasis is on centralized planning and bureaucratic and regulatory control of variables to dampen economic fluctuations. The same stabilization mentality is transmitted to corporations, encouraging cost controls, process management, and risk mitigation. Corporate collaboration with the public sector is a favored strategy in bidding for government contracts, participating in public–private partnerships, and lobbying for sheltering legislation.

What is to be done? Aberrant Capitalism frames the action plan as reimagination.

Restoration of the Primacy of the Customer: A newly reimagined corporate capitalism must restore the customer to a primary position before shareholders, governments, or management. The customer is the source of energy in the capitalist system of value creation and betterment – it’s their desire for improved well-being that is the driver. This mindset has been lost. Restoring it would bring us business models that prize customer value over shareholder value, dynamic innovation over predictable, smooth earnings, and long-term growth horizons over short-term asset appreciation and payouts.

The energy of customer primacy was fully evident in the golden age, but current corporate ideology violates all three of these business model characteristics.

Reimagining the economics of capitalism: In economics, the process of value creation is known as entrepreneurship. This term has lost its original meaning of undertaking the uncertain task of creating new value for customers. In the popular vernacular, it has come to be associated with the launch of new firms and the management of small businesses. But, as the pursuit of new economic value on behalf of customers, the economic function of entrepreneurship should be the corporation’s primary focus.

For capitalism to transcend the current aberrant period, it will be necessary to restore the primacy of the entrepreneurial function (something management guru Peter Drucker envisaged in 1993 when he wrote that entrepreneurship should become the “integrating …. life-sustaining activity in our organizations, our economy, our society”).

Reimagining the Relationship with Capital Markets: There are alternatives to the high liquidity, low-risk equity, short-term stock trading markets of today that are the source of the incentives behind aberrant capitalism. Some sovereign wealth funds are already focusing on long-term rolling returns (20 years for GIC, the Singaporean wealth fund), and different ownership structures (such as family or private ownership) can favor the longer-term horizon.

Reimagining management: Aberrant Capitalism records five different management ideology eras, and the digital age promises the possibility of another new one. The new management purpose is always some distinctive and differentiated variant of obsession with creating a superior value experience for customers. As a consequence of the new speed of change, management becomes more discovery than determinate, more humble than hubristic, and more uncertain than predictive. Principles replace bureaucratic rules. Leadership becomes more distributed, and organizations become flatter. Subjective calculation of future customer value means that the accounting discipline, which translates every action into numbers, is no longer the only source of management truth.

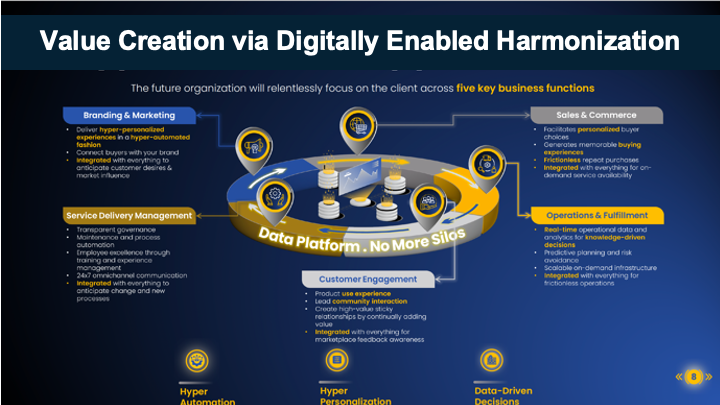

The promise of the digital age, which enables a new software-mediated direct relationship between corporations and customers, is to reverse the direction of entropic decline in corporate capitalism. There is a new dynamic in motion that points to the potential for a return to the golden age of corporations, where owner-entrepreneurs harnessed new technology for the good of customers, bending the curve of prosperity and well-being into a steeper ascent. The direction of motion in the new system is from the customer directly to the corporation via networks and software, permitting a more direct influence of customer preferences on resource allocation and management practices.

Corporations can no longer be fortresses, defining and defending boundaries to establish dominant positions in markets or industries. They must compete on customer satisfaction, replace hierarchies with networks, abandon control for riding the wave of technological innovation, disentangle themselves from the boat anchor of government, and redefine their relationships with employees so that profit is the outcome of a satisfied customer interacting with a satisfied workforce. This is the concept of entrepreneurial management: combining the values of entrepreneurial ownership that characterized the first large-scale corporations with the harnessing of technology to directly improve the well-being of every customer and thereby achieve new levels of quality of economic life that couldn’t be contemplated back then.

Epilogue: Aberrant Capitalism

Capitalism’s reputation has been tarnished, and its true purpose distorted. The consequences are dire: a widening chasm of inequality, disillusionment, and distrust, and the empowerment of those who would see the entire system dismantled. This twisted form of capitalism stands as a stark warning of the dangers that arise when we allow the forces of centralization, financialization, and the shortsighted pursuit of shareholder value to dictate the course of our economic system.

It is our responsibility as the inheritors of capitalism’s promise to reassert the values that underpin this system: the power of free markets to drive innovation, the potential of business to uplift societies, and the inherent dignity of labor. Only by acknowledging the threats and working tirelessly to counteract their effects can we reclaim the true spirit of capitalism and ensure a more equitable, prosperous future for all.